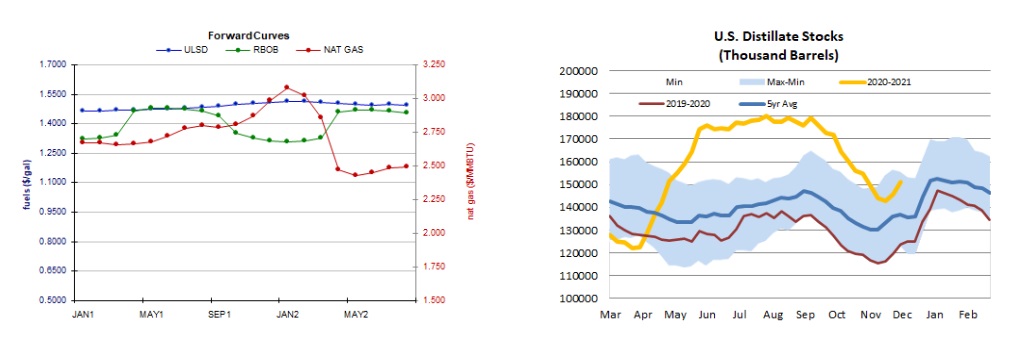

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

Petroleum futures strengthened further today amid gains in US equities and weakness in the US dollar, despite fresh lockdowns in Europe and a bearish revision to its oil demand forecast by the IEA. The International Energy Agency cut its 2020 oil demand forecast by 50kb/d and also revised down its 2021 forecast by 170kb/d, citing weaker jet fuel use as fewer people travel by air. European shares closed mixed today with the FTSE 100 down 0.28%, while the CAC 40 edged up 0.04% and the DAX added 1.06%. In North American economic news, US industrial production rose 0.4% last month, just above expectations at 0.3%. Canadian housing starts rose from 215,134 in October to 246,033 in November, well above the Econoday consensus at 215,000. On the other hand, manufacturing sales in Canada only rose 0.3% in October, below expectations at 0.6%. Also unsupportive, the Empire State Manufacturing Index fell from 6.3 to 4.9 this month, missing forecasts at 5.8. As of this writing, US stock market indexes were seeing gains of between 0.8% (Nasdaq) and 1.1% (Dow, S&P 500). Also supportive, the US dollar index was down 0.3%.

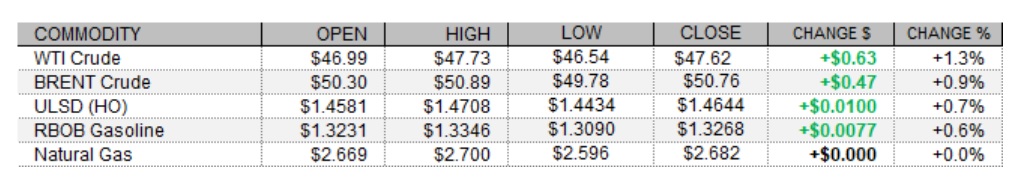

FORWARD CURVES AND US DISTILLATE STOCKS

NATURAL GAS | WEATHER | INVENTORIES

Natural gas futures settled flat today despite a weaker two-week heating degree day forecast and a looser market balance expectation for next week. Refinitiv analysts now see total US demand of 122.5bcf/d outpacing US supply at 99.4bcf/d next week, implying smaller withdrawals of 23.1bcf/d (compared to yesterday’s forecast at 23.8bcf/d). The Global Forecast System cut its heating degree day forecast for the next two weeks by 2 to 421, which is below the 30-year average of 442, but well above last year's 370 HDDs over the same period. The latest 1-5 day outlook (EC) sees well below-normal temperatures in the Northeast, while mixed temperatures are expected in the Midwest. The 6-10 day forecast is less supportive as above-normal temperatures are seen across the eastern two thirds of the country. In the cash market today, prices at the Henry Hub benchmark rose from $2.54 to $2.69/mmBtu, Transco Zone 6 prices in New York jumped from $2.05 to $2.77/mmBtu, and Algonquin citygate prices jumped from $2.69 to $5.95/mmBtu. According to a Reuters poll of analysts, estimates for the weekly EIA petroleum inventory report for the week ended December 11 call for a 1.9mb draw from US crude stocks amid a 0.7 percentage point predicted increase in the nation’s refinery utilization rate. On the other hand, distillate stocks are expected to rise by 0.9mb and gasoline stockpiles are expected to increase by 1.6mb. API petroleum inventories for the same week are due this afternoon at 4:30.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures edged up 0.7% today in an upside session, printing a hanging man candlestick pattern. This can be a bearish reversal pattern, and we do have an overbought RSI (76.0). However, slow stochastics are not quite in overbought territory to provide confirmation, and the major averages, ADX, and MACD also point higher. Still, we'll stubbornly stick to our neutral stance for now, looking to today's high of $1.4708 and then to the $1.5000 psychological level for resistance, whereas the 9-day ma ($1.4213) and then $1.3500 remain our nearby support levels. RBOB futures, where we have been sided with the bulls, added 0.6% today in an upside session. Today's candlestick was a Doji star, indicating ambivalence, and slow stochastics are entering overbought territory. The RSI at 67.3, however, cannot provide confirmation just yet. Major averages and the MACD point higher and we'll continue to favor the upside for now, still seeing $1.3500 and then $1.3899 resistance, with 18-day ma ($1.2592) and then 100-day ma ($1.2040) support. We've been neutral on WTI but prices strengthened 1.3% today in an upside session. Slow stochastics are not yet overcooked, but the RSI is. On the other hand, candlesticks, the MACD, and major averages all point higher now. On the other hand, we haven't matched the highs December 10 just yet. We'll stick to the sidelines for now, looking to $50.54 and then $52.17 for resistance, with 9-day ma ($46.31) and then $43.79 support. Finally, NYMEX NG futures settled unchanged today in a downside session, inconsistent with our upside bias. Slow stochastics are nearly overbought, but the RSI is quite neutral (49.1) and the MACD has crossed bullishly below the zero line (and is therefore now a neutral indicator). We'll stick to our guns for the moment, continuing to eye $2.762 and then $2.898 for resistance, with 100-day ma ($2.544) and then $2.403 support