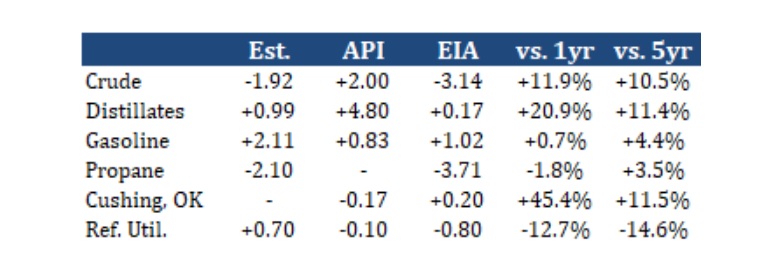

The Weekly Petroleum Status Report released this morning by the Energy Information Administration (EIA) was supportive all around, showing a larger than expected draw from commercial crude oil stockpiles, a smaller than expected increase in distillate stock levels, a smaller than predicted rise in gasoline inventories, and a surprisingly large drop in combined propane and propylene inventories.

Commercial crude oil inventories fell by 3.14mb last week, outpacing the 1.92mb dip predicted by analysts, as net imports and production slowed. US inventories fell to 500.1mb, but this drop was seasonal and this level is still well above the five-year range, 10.5% above the weekly five-year average, and 11.9% above last year's levels for the reporting week. Whereas overall stock levels fell - mostly on the Gulf Coast where there are ad-valorem tax implications for year-end - Cushing, OK inventories added 0.20mb, reaching 58.41mb. This is 11.5% above the five-year average and 45.4% higher than last year's levels.

Imports dropped 1.06mb/d to average 5.42mb/d last week, which is 1.16mb/d lower than last year at this time. Meanwhile, exports picked up by 0.79mb/d to 2.63mb/d, although this is still 1.01mb/d lower than last year. That's still a 1.85mb/d drop in net imports for the week, the main contributor towards the weekly stock draw. In addition, US oil production fell by 0.10mb/d to 11.00mb/d, which is 1.80mb/d lower than last year and down 2.10mb/d from the highs earlier this year. With prices back above $40/bbl for some time now, rig counts have been rising - and the drop in the drilled but uncompleted (DUC) well count indicates much of this is driven by lower-cost (compared to new drill) completions. However, EIA expects US shale production to continue to slow, including in January as of its latest forecast. Most of the decline is seen occurring in the Permian and Eagle Ford plays.

Distillate stock levels, expected to rise by 0.99mb, saw a 0.17mb uptick last week. While this was quite neutral, it was supportive against API data showing a 4.80mb build. The smaller than predicted build came as implied demand and exports rose by a combined 0.87mb/d, whereas production and imports increased by just 0.15mb/d combined. Implied demand was the main driver, jumping 0.61mb/d higher for a relatively soft week in the previous report, to average 4.00mb/d - still 0.12mb/d lower than last year. Exports picked up by 0.26mb/d to 1.07mb/d, which is 0.16mb/d higher than last year. On the other side of the equation, production fell by 0.07mb/d to 4.60mb/d, which is 0.47mb/d lower than last year. Imports picked up by 0.21mb/d to 0.49mb/d, which is 0.31mb/d higher than last year. The East Coast saw a 0.56mb build last week, pushing stock levels up to 60.94mb. This is 17.1% higher than the five-year average for the week and 42.9% higher than last year. The regional inventory cushion remains very strong. Overall US inventories are also in solid shape near the top of the weekly five-year range, 11.4% higher than the five-year average, and 20.9% stronger than last year at this time. The trend calls for stocks to rise for a few more weeks before turning lower in January with the colder temperatures.

Gasoline stocks grew by 1.02mb, half the expectation, as implied demand picked up and imports slowed, even as export activity waned and production increased. Implied demand rose by 0.38mb/d to average 7.98mb/d. This is still, however, 1.44mb/d lower than last year. Both gasoline and jet fuel demand has been heavily impacted by the pandemic, but the impact to overall distillate demand has been more muted. Gasoline exports fell by 0.12 to 0.78mb/d last week, which is 0.19mb/d higher than last year. Imports fell by 0.18mb/d, averaging 0.61mb/d last week (about flat to last year), but this was offset by a 0.18mb/d rise in production, which average 8.52mb/d (still 1.32mb/d lower than last year).

Combined propane and propylene stock levels dropped 3.71mb lower last week, exceeding expectations at 2.10mb. Implied demand of 1.67mb/d and exports of 1.36mb/d continued to outpace the sum of 2.32mb/d of production and 0.18mb/d of imports. Gulf Coast stocks dropped 2.32mb lower to 45.84mb, which is 3.6% below the weekly five-year average. By contrast, Midwestern inventories - which had been at a deficit to historical levels for much of the year - are 2.3% above their five-year average despite a 1.68mb draw last week, with inventories sitting at 24.09mb. East Coast stocks saw a counter-seasonal build of 0.36mb, rising to 8.32mb. PADD 1 storage levels are 29.2% higher than the five-year average. US inventories are 3.5% higher than the average for the last five years, but now 1.8% lower than last year.