PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

Petroleum futures spent most of the morning south of the unchanged mark, but the latter half of the session above it, with strength in equities, fresh multi-year lows in the US dollar index, and a supportive weekly EIA inventory report. It was an active day on the economic calendar. Composite PMI indexes from Markit showed the Eurozone economy approached breakeven this month (49.8), beating expectations, the French economy did the same (49.6), and the expansion in the German economy accelerated faster than expected (52.5). Germany's DAX rallied 1.5% and the CAC 40 in France rose 0.3%. The flash December Markit Composite PMI for the UK came in at 50.7, missing the 51.3 forecast but back in expansionary territory. The FTSE 100 jumped 0.9% higher. US economic data were all around disappointing. The NAHB Housing Market Index for December fell further than expected to 86, the flash Markit Composite PMI fell further than expected to 55.7, and retail sales saw a sharper than expected drop of 1.1% last month.

NATURAL GAS | WEATHER | INVENTORIES

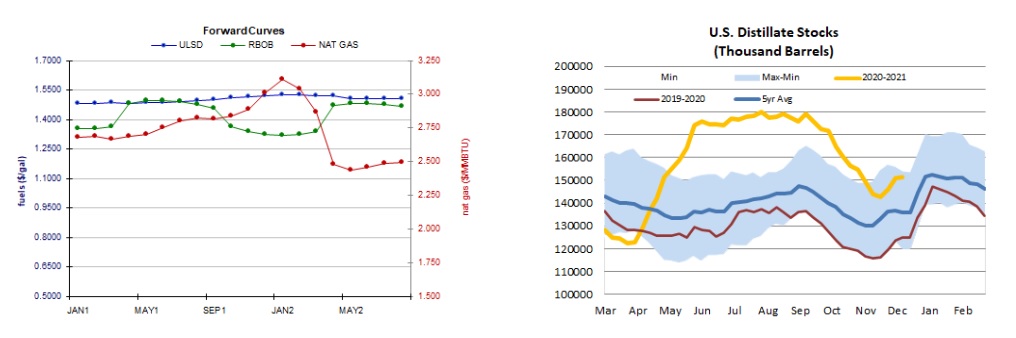

Natural gas futures lost ground today with a downgrade to the two-week heating degree day forecast and a looser market balance expectation for next week. The Global Forecast System cut its two-week HDD forecast by 16 to 405, which is well below the 30-year average of 444, but tops last year's 373 HDDs during the same period. The latest 1-5 day outlook from the ECMWF calls for above-normal temperatures in the Midwest, but below-normal temperatures along the eastern seaboard. The 6-10 day forecast, however, sees above-normal temperatures across most of the country. Refinitiv analysts cut their total US demand forecast for next week by 0.8 to 121.7bcf/d, while trimming the supply forecast by just 0.1 to 99.3bcf/d, implying smaller withdrawals of 22.4bcf/d. The EIA is due to release its weekly natural gas storage report tomorrow. Analysts polled by Reuters see a 111bcf withdrawal being reported for the week ended December 11, which would top both last year's 97bcf withdrawal and the 105bcf five-year average. In the cash market, price action was mixed today. Benchmark Henry Hub prices slipped 6 cents lower to $2.63/mmBtu, but Transco Zone 6 prices at the New York citygate shot up $1.35 to $4.12/mmBtu and Algonquin citygate prices jumped $1.55 higher to $7.50/mmBtu with a winter storm approaching.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures rose 0.9% in an upside session. Slow stochastics are overbought and the RSI confirms overbought conditions (77.2), while the MACD and candlesticks are bullish. We are going to stick to our neutral stance for now, seeing nearby support at $1.4815 (today’s high) and then up at $1.5000, while the 9-day ma ($1.4305) and $1.3500 are expected to offer support. RBOB futures added 2.0% in an upside session today – consistent with our bullish bias which we maintain. Bulls took out the $1.3500 resistance level, so now we look at $1.3899, followed by $1.4000 for resistance, whereas the 18-day ma ($1.2698) and then the 100-day ma ($1.2048) are seen as nearby support levels. WTI futures, where we were neutral, edged up 0.4% in an upside session. Slow stochastics look set to cross into overbought territory and the RSI at 70.9 confirms overbought conditions, while the MACD and candlesticks point higher. We are going to remain neutral, still seeing nearby support at the 9-day ma ($46.54) and then down at $43.79, with $50.54 and $52.17 as nearby resistance levels. Natural gas futures edged down 0.2% in an inside session – inconsistent with our bullish bias. Slow stochastics are overbought but the RSI is neutral, along with candlesticks and the MACD. We are going to fall back on the sidelines, awaiting further developments, still seeing nearby support at the 100-day ma ($2.554) and then at $2.403, while $2.762 and $2.898 are our nearby resistance levels.