PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

Petroleum futures strengthened for a fourth consecutive session amid gains in US equities and further weakness in the US dollar index. European shares closed mixed today with the FTSE 100 down 0.3%, while the CAC 40 closed flat, and the DAX added 0.8%. In US economic news, housing starts rose up from a downwardly-revised annualized rate of 1.528m in October to 1.547m in November, beating the Econoday consensus at 1.530m. Permits were also a beat as they came in at 1.639m, well above the 1.553m consensus. On the other hand, weekly initial jobless claims came in at 885,000, well above expectations at 806,000 and up from 862,000 the prior week. Also unsupportive, the Philadelphia Fed Manufacturing Index for December fell from 26.3 to 11.1, while forecasts called for a smaller decline to 21.1. As of this writing, US stock market indexes were seeing gains of between 0.4% (Dow) and 0.6% (Nasdaq). Also supportive for crude oil prices, the US dollar index continued its slide and was down 0.7%.

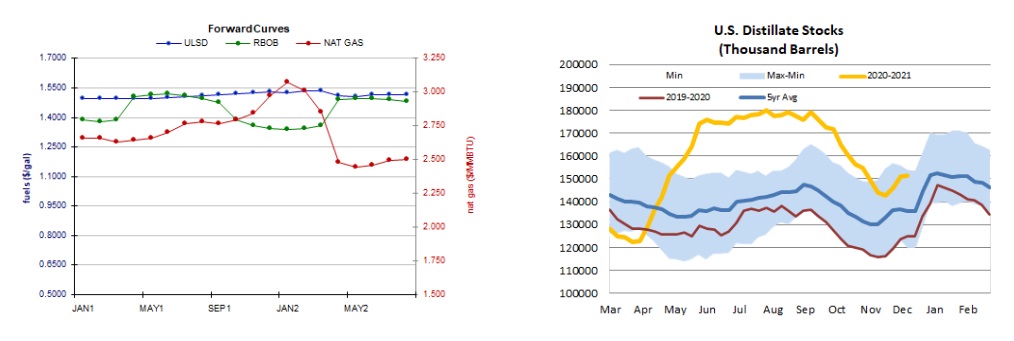

FOWARD CURVES & US DISTILLATE STOCKS

NATURAL GAS | WEATHER | INVENTORIES

Natural gas futures weakened further today despite a stronger two-week heating degree day forecast, a tighter market balance expectation for next week, and a bullish weekly storage report from the Energy Information Administration (EIA). The EIA reported a 122bcf withdrawal from underground natural gas storage for the week ended December 11, above forecasts at 120bcf. Total storage levels fell to 3.726tcf, which is 8.3% higher than last year and 7.0% above the five-year average for the reporting week. Refinitiv analysts now see total US demand of 122.9bcf/d outpacing US supply at 99.4bcf/d next week, implying larger withdrawals of 23.5bcf/d (compared to yesterday’s forecast at 22.4bcf/d). The Global Forecast System raised its heating degree day forecast for the next two weeks from 405 to 416, which is closer to the 30-year average of 446, but well above last year's 373 HDDs over the same period. The latest 1-5 day outlook (EC) sees above-normal temperatures in the Midwest, but below-normal temperatures in the Northeast. The 6-10 day forecast is less supportive with above-normal temperatures expected in both regions. In the cash market today, prices at the Henry Hub benchmark rose from $2.63 to $2.73/mmBtu, Transco Zone 6 prices in New York rose from $4.12 to $5.38/mmBtu, and Algonquin citygate prices jumped from $7.50 to $9.50/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures added 1.2% in a low-volume upside session today. Slow stochastics and the RSI are still overbought, while candlesticks and the MACD are bullish. Bulls took out $1.4815 resistance (yesterday’s high) and tested but failed to take out the $1.5000 resistance level. We now see nearby resistance at $1.5000, followed by $1.5500, while the 9-day ma ($1.4411) and $1.3500 are expected to offer support. We are going to side with the bulls now, hoping we are not too late to the party. RBOB futures rose 2.6% in an upside session – consistent with our bullish bias which we continue to maintain. We continue to see nearby resistance at $1.3899 and then up at $1.4000, whereas the 18-day ma ($1.2816) and the 100-day ($1.2061) are seen offering support. WTI settled 1.1% higher in an upside session as well. Technical indicators are similar to those in ULSD and we are going to take a bullish stance now, still seeing nearby resistance at $50.54 and then up at $52.17, with the 9-day ma ($46.78) and $43.79 as nearby support levels. Finally, NYMEX natural gas futures settled 1.5% lower in an outside session – consistent with our neutral bias. We remain neutral with nearby support seen at the 100-day ($2.562) and then at $2.403, while $2.762 and $2.898 are expected to offer resistance.