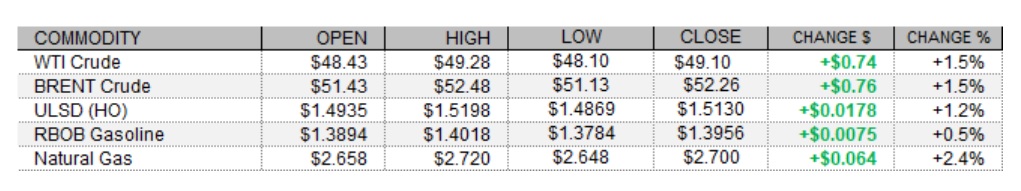

Petroleum Complex

The complex extended its rally to a fifth consecutive session today, despite weakness in US and European shares, strength in the US dollar, and a rise in the US oil rig count. In economic news today, the CPI in Japan fell 0.4% m/m. Excluding food and energy, the consumer price level was stable. The Bank of Japan made no changes to monetary policy settings, consistent with market expectations. In European news, UK retail sales dropped 3.8% last month, but this was better than the 4.2% drop predicted by analysts. In Germany, the Ifo business climate index of 92.1 this month beat forecasts at 90.5 and was an improvement from last month's 90.9 reading. Nevertheless, the DAX slipped 0.3% lower, as did the FTSE 100, and the CAC 40 lost 0.4%. In North American news, Canadian retail sales grew 0.4% in October, beating the 0.1% forecast. US stock market indexes also looked set to end their rally today, with the Dow down 0.6%, the S&P 500 having lost 0.7%, and the Nasdaq off 0.2% as of this writing. Also unsupportive for crude oil, the US dollar index was up off of yesterday's multi-year lows with a 2% gain. News on the supply side was also unsupportive, with Baker Hughes reporting a rise of 5 in the US oil rig count this week, to 263. This is, however, still a drop of 422 from the same week last year.

NATURAL GAS | WEATHER | INVENTORIES

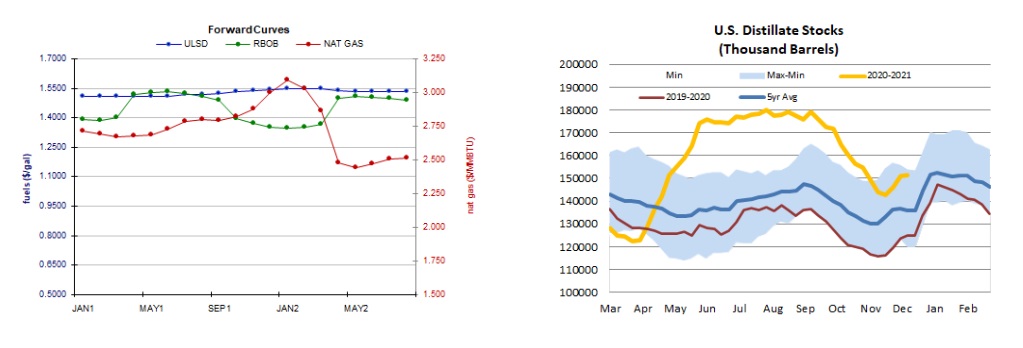

Natural gas futures strengthened some today, with a tightening picture of next week's market balance, despite another weekly rise in the rig count. Refinitiv sees total US demand averaging 123.6bcf/d next week, 0.7bcf/d higher than in yesterday's estimate, outpacing total US supply of 99.4bcf/d by 24.2bcf/d. Most states along the East Coast are expected to see below-normal temperatures over the next 5 days according to the latest ECMWF forecast, but Midwestern states are expected to see above-normal temperatures. The 6-10 day outlook is mixed and near-normal. The Global Forecast System sees 417 HDDs over the next two weeks, a slight uptick from yesterday's 416-HDD forecast and above last year's 373 HDDs, but below the 30-year average of 448. In unsupportive supply-side news, Baker Hughes reported a rise in the US natural gas rig count of 2 to 81 this week. This is 44 lower than last year at this time. Cash natural gas prices were mixed today. Benchmark Henry Hub prices shed 3 cents, hitting $2.70/mmBtu, and Transco Zone 6 prices in New York fell by 11 cents to $5.27/mmBtu, but Algonquin citygate prices shot up $2.00 to $11.50/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

We were late, but not altogether too late in siding with ULSD bull yesterday, as futures continued higher with a 1.2% gain to levels not seen since early March. There was also relatively strong volume behind today's move. We now look to today's $1.5198 high and then to $1.5500 for nearby resistance, whereas the 9-day ma ($1.4536) and then $1.3500 are our nearby support levels. Candlesticks, the MACD, major averages, and ADX all point higher - but both the RSI and slow stochastics are overbought, indicating a consolidation or retracement could occur in the coming sessions. RBOB futures were kind to our upside bias, adding 0.5% in an upside session - but printing a Doji star, which can be a reversal pattern. Both slow stochastics and the RSI are overbought. Until we see evidence that the trend has ended, we'll continue to favor upside changes, seeing resistance at $1.4913 and then $1.5427, whereas $1.3899 (taken out today) and then the 18-day ma ($1.2922) are our nearby support levels. WTI was also kind to our views, adding another 1.5% in an upside session. Both the RSI and slow stochastics are overbought and the latter look set to cross for a sell signal, however. Nearby resistance at $50.54 and then $52.17, with 9-day ma ($47.14) and then $43.79 support. Natural gas futures added 2.4% in an upside session, but trade remains quite sideways over the past five sessions and we'll stick to the sidelines - helped by overbought and falling slow stochastics. Nearby support at the 100-day ma ($2.571), followed by $2.403, with $2.762 and then $2.898 resistance.