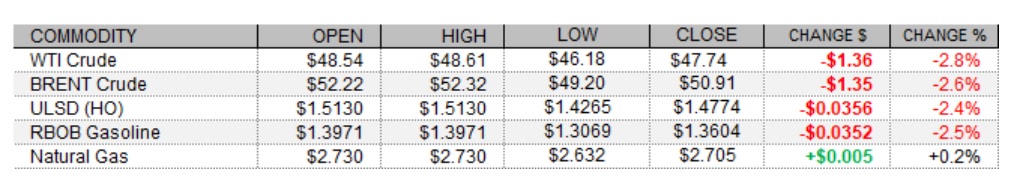

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

The complex snapped a five-session rally, seeing fairly heavy losses amid weakness in equities and strength in the US dollar, with news of the spread of a new and more infectious strain of the coronavirus in the UK. Reuters reports that the news strain is thought to be 70% more infectious, that the UK is tightening restrictions, and that many countries are closing their borders to Britain. Additionally, Brexit is not far off now. The FTSE 100 dropped 1.7% lower, but closed well off of the lows. The CAC 40 dropped 2.4% and the DAX fell 2.8% today. The losses came despite encouraging flash Eurozone economic confidence data, with the European Commission index up unexpectedly from -17.6 last month to -13.9 this month. As of this writing, US stock market indexes were mixed near the unchanged mark. Some support may have been lent from the passage of a second coronavirus stimulus package, which was added on to a government funding bill. The S&P 500 was down 0.4%, the Nasdaq was off 0.2%, and the Dow had recovered to post a 0.2% gain as of this writing. The US dollar index was far off of its highs, which had been at levels not seen since December 14, but was still unsupportive for crude with a 0.2% rise.

FORWARD CURVES & DISTILLATE STOCKS

NATURAL GAS | WEATHER | INVENTORIES

NYMEX natural gas futures edged up today with a stronger two-week heating degree day forecast, despite a looser market balance forecast for this week. The Global Forecast System sees 419 HDDs over the next two weeks, up from 417 in the previous outlook, and well above last year's 330 HDDs. On the other hand, Refinitiv analysts raised their total US supply forecast for this week from 99.4 to 99.9bcf/d, while trimming their total demand forecast from 123.6 to 121.6bcfd, implying smaller withdrawals from storage. The market is seen tightening next week, with demand rising to 126.7bcf/d and supply edging up just 0.1bcf/d to 99.5bcf/d. The latest 1-5 day ECMWF outlook calls for above-normal temperatures in both the Midwest and, especially, in the Northeast. The 6-10 day forecast is more supportive, however, with mixed temperatures in the Midwest but below-normal temperatures for much of the East Coast save for Maine. In the cash market today, natural gas prices were mixed. Benchmark Henry Hub prices added 3 cents to hit $2.73/mmBtu, but Transco Zone 6 prices at the New York citygate dropped down from $5.27 to $2.76/mmbtu. Algonquin citygate prices also softened appreciably, down from $11.50 to $6.55/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures gapped lower over the weekend and then tumbled down to their weakest levels since December 14 during today's average-volume downside session. However, futures recovered and settled in the top half of the daily range and back above 9-day ma support ($1.4615) for a 2.4% loss. We abandon the bulls, conceding that we missed most - but not all - of the rally. We'll be looking to see if bears can follow through tomorrow. After the 9-day ma, we see support at $1.3500, whereas the recent $1.5198 high and then $1.5500 are expected to offer resistance. RSI is bearish, slow stochastics have crossed for a sell signal in overbought territory and are bearish has well, but the MACD, major averages, and ADX all still point higher. RBOB futures gapped slightly higher over the weekend, but also took an intraday tumble to the weakest levels since December 14 and below the 9-day ma, but recovered to close near the middle of the daily range with a 2.5% loss. We see $1.3899 and then $1.4913 resistance, with 18-day ma ($1.2979) and then $1.2008 support. We'll fall back to a neutral stance here, as we do with WTI, which lost 2.8% in a downside session. We settled above 9-day ma support ($47.39), which is followed by $43.79. We see nearby resistance at $50.54 and then $52.17. As with products, overbought stochastics have crossed for a sell signal. NYMEX natural gas futures edged up 0.2% today but in an outside session (higher high, but also a lower low), printing a hammer-shaped candlestick. The lows were near the 9-day ma ($2.630). We remain neutral, seeing 100-day ma ($2.579) and then $2.403 support, with $2.762 and then $2.898 as our nearby resistance levels.