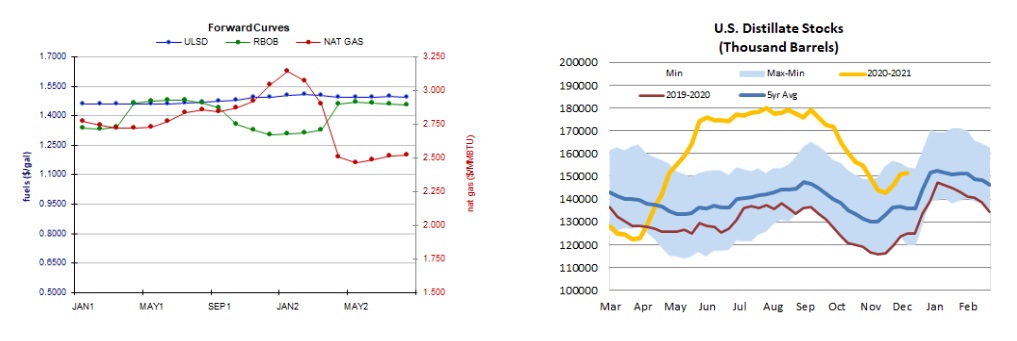

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

Petroleum futures settled in the red for a second consecutive session amid strength in the US dollar and mixed trade in US equities, despite gains in European shares. In US economic news, the final estimate of Q3 GDP growth showed an upward revision from 33.1% to 33.4%. On the other hand, the Conference Board's Consumer Confidence Index fell from a downwardly-revised 92.9 to 88.6 this month, while expectations called for an increase to 97.0. Existing home sales came in at a 6.690m annualized pace last month, falling from 6.850m the prior month and short of expectations at 6.720m. European shares closed in the black today with the FTSE 100 up 0.6%, the DAX adding 1.3%, and the CAC 40 gaining 1.4%. As of this writing, US stock market indexes were trading mixed with the Dow down 0.3%, the S&P 500 trading flat, and the Nasdaq up 0.4%. The US dollar index continued higher and was up 0.7%, which is unsupportive for crude oil prices.

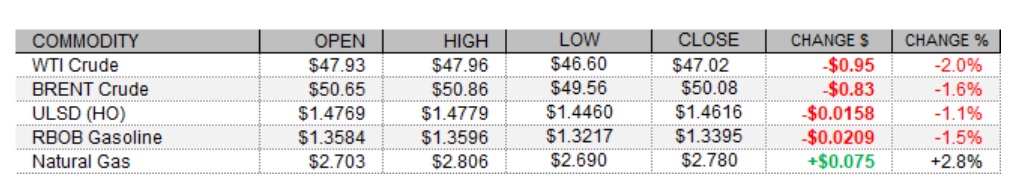

FORWARD CURVES & STOCKS

NATURAL GAS | WEATHER | INVENTORIES

Natural gas futures strengthened further today amid a stronger two-week heating degree day forecast and a tighter market balance expectation for next week. Refinitiv analysts now see total US demand of 132.0bcf/d outpacing US supply at 100.0bcf/d next week, implying larger withdrawals of 32.0bcf/d (compared to yesterday’s forecast at 27.2bcf/d). The Global Forecast System raised its heating degree day forecast for the next two weeks by 9 to 428, which closer to the 30-year average of 454, but well above last year's 329 HDDs over the same period. The latest 1-5 day outlook (EC) sees above-normal temperatures in both the Northeast and the Midwest. The 6-10 day forecast is more supportive with mixed and near-normal temperatures expected in both regions. In the cash market today, prices at the Henry Hub benchmark fell from $2.73 to $2.68/mmBtu and Algonquin citygate prices dropped from $6.55 to $4.20/mmBtu, while Transco Zone 6 prices in New York rose from $2.76 to $2.98/mmBtu, and Algonquin citygate prices jumped from $2.69 to $5.95/mmBtu. According to a Reuters poll of analysts, estimates for the weekly EIA petroleum inventory report for the week ended December 18 call for a 3.2mb draw from US crude stocks amid a 0.5 percentage point predicted increase in the nation’s refinery utilization rate. Distillate stocks are expected to fall by 0.9mb, whereas gasoline stockpiles are expected to increase by 1.2mb. API petroleum inventories for the same week are due this afternoon at 4:30.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures fell further today, but in an inside session as today's low was much higher than yesterday's, and we settled well off of even today's lows near the middle of the daily range. Volume was very thin with the holiday this week. On the other hand, we did see nearby 9-day ma support ($1.4684, becomes nearby resistance) taken out today, and now the RSI, slow stochastics, and candlesticks all point south. We'll adopt a neutral/bearish stance, with trepidation. Next support expected at $1.4000 and then $1.3500, whereas that 9-day ma and then the recent $1.5198 high are our resistance levels. Technical indicators for RBOB are similar, where we fell in an inside session and settled near the middle of the daily range but below the 9-day ma ($1.3451). The 18-day ma has been more reliable for RBOB historically, however, and so we continue to look there ($1.3008) for nearby support, followed by $1.2008, whereas $1.3899 and $1.4913 remain our nearby resistance levels. As with ULSD, we adopt a neutral/bearish stance. WTI fell 2.0% today in an inside session, taking out 9-day ma support ($47.54). This becomes nearby resistance, followed by the recent $49.28 high, whereas $45.27 and then $42.02 are our new support levels. As with products, we adopt a neutral/bearish stance. Natural gas futures continued higher today, taking out $2.762 resistance (now nearby support) and threatening the 50-day ma ($2.817). Slow stochastics have recrossed bullishly, but are still just south of overbought territory. The RSI (54.4) has plenty of room overhead, however, and so we'll adopt a flat-to-higher price view, seeing next resistance at $2.898 and then at $3.000.