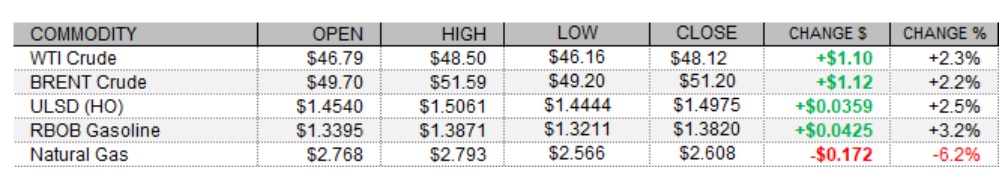

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

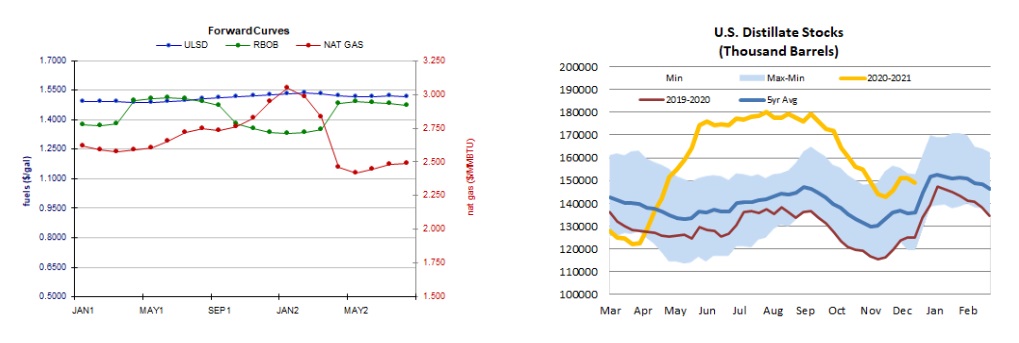

Petroleum futures turned back higher and posted respectable gains amid strength in equities and weakness in the US dollar, as well as supportive products stock data from the EIA - despite bearish weekly US crude oil inventories. The FTSE 100 added 0.7% today, trailing a 1.1% gain in the CAC 40 and a 1.3% rise in the DAX. In economic news today, Canadian GDP growth of 0.4% in October beat the 0.2% expectation. US data were more mixed. In positive news, durable goods orders growth of 0.9% last month beat the 0.6% expectation and weekly initial jobless claims fell to 803,000 - beating consensus at 875,000. On the other hand, personal incomes fell by a sharper than predicted 1.1% last month and personal consumption expenditures saw a sharper than predicted drop of 0.4%. Inflationary pressures remain muted per a 1.4% year-on-year rise in the Core PCE last month. Also unsupportive was a miss in the final University of Michigan consumer sentiment index, which fell to 80.7. News on the supply side was also unsupportive, as the oil rig count rose yet again this week - albeit by just 1 to 264, which is a drop of 413 from the same week last year.

Forward Curves & Stocks

NATURAL GAS | WEATHER | INVENTORIES

Natural gas futures turned back south today and took a tumble, with a rise in the rig count, a smaller than expected withdrawal from storage in the weekly EIA report, and a looser market balance expectation for next week, despite a stronger heating degree day forecast for the next two weeks. EIA reported a 152bcf withdrawal from underground storage for the week ended December 18, releasing its report a day early due to the holiday this week. Total storage levels fell to 3.574tcf, which is 8.4% higher than last year and 6.5% above the five-year average for the week. Also unsupportive, Baker Hughes reported a rise of 1 in the US rig count this week, to 83. Refinitiv analysts raised their total US supply forecast for next week by 0.1bcf/d to 100.1bcf/d, while cutting their total US demand forecast by a sharp 4.1bcf/d to 127.9bcf/d, implying smaller withdrawals from storage of 27.8bcf/d. The latest 1-5 day ECMWF outlook sees higher than normal temperatures in the Northeast, with especially high deviations above normal in New England. The Midwest is expected to see mixed temperatures. The 6-10 day outlook calls for mixed but mostly below-normal temperatures in the Midwest and above-normal temperatures on the East Coast. The Global Forecast System sees 435 HDDs over the next two weeks, up from the previous forecast of 428 but still below the 30-year average of 456.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures rose 2.5% in an outside session (higher high, lower low). Bulls took out the 9-day ma ($1.4756), which now becomes nearby support, followed by $1.4000, while $1.5198 and $1.5500 are our nearby resistance levels. Slow stochastics are still bearish, while the RSI is overbought, and the MACD and candlesticks are neutral. We are going to remain neutral/bearish. RBOB futures added 3.2% in an outside session with bulls taking out the 9-day ma ($1.3523). Slow stochastics look set to cross bullishly in a neutral territory, while the RSI continues to point lower, and the MACD is still bullish. We are going to stick to our neutral/bearish stance for now, still seeing nearby support at the 18-day ma ($1.3064) and then down at $1.2008, while $1.3899 and $1.4913 are expected to offer resistance. Similar to the products, WTI futures rose 2.3% in an outside session. We are going to remain neutral/bearish, seeing nearby support at the 9-day ma ($47.70 – taken out today) and then at $45.27, whereas $49.28 (recent high) and $52.17 are seen as nearby resistance level. Inconsistent with our neutral/bullish stance, natural gas futures tumbled 6.2% in a downside session with bears taking out the 9-day ma ($2.673) and the 18-day ma ($2.638) and testing but failing to take out the 100-day ma ($2.594). Slow stochastics, the RSI and the MACD all point lower and we are going to remain neutral for now awaiting further developments. We now see nearby support at the 100-day ma and then down at $2.527, with $2.762 (taken out today) and $2.898 seen as nearby resistance levels.