PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

Petroleum futures settled flat to lower in a very thin pre-holiday session today despite modest gains in US equities and weakness in the US dollar, as well as news that the UK and the EU signed a Brexit trade agreement. Reuters reported that Britain and the EU struck a post-Brexit trade deal today, a week before the UK is set to leave the EU (on December 31 at 11:00pm). It was a quiet day on the economic calendar. European stock markets were closed today. US stock market indexes were trading flat to higher as of this writing with the Dow steady, while the S&P 500 and the Nasdaq were up 0.1%. The US dollar index was down 0.1%, which is supportive for crude oil prices.

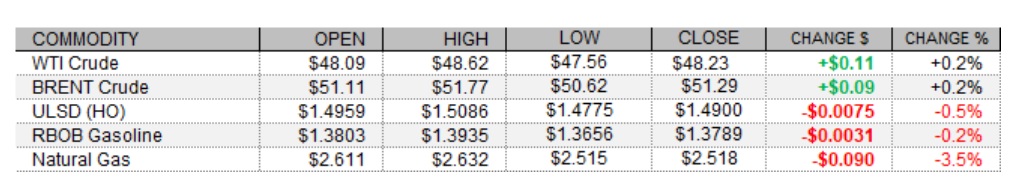

Forward Curves ULSD RBOB NAT GAS

NATURAL GAS | WEATHER | INVENTORIES

Natural gas futures weakened further today amid a weaker two-week heating degree day forecast and a looser market balance expectation for next week. Refinitiv analysts now see total US demand of 126.2bcf/d outpacing US supply at 100.3bcf/d next week, implying smaller withdrawals of 25.9bcf/d (compared to yesterday’s forecast at 27.8bcf/d). The Global Forecast System cut its heating degree day forecast for the next two weeks by 2 to 433, which is below the 30-year average of 457, but well above last year's 340 HDDs over the same period. The latest 1-5 day outlook (EC) sees above-normal temperatures in the Northeast, but mostly below-normal temperatures in the Midwest. The 6-10 day forecast is less supportive with above-normal temperatures expected across the eastern half of the country. In the cash market today, prices at the Henry Hub benchmark fell from $2.76 to $2.68/mmBtu, Transco Zone 6 prices in New York dropped from $2.73 to $2.18/mmBtu, and Algonquin citygate prices dropped from $3.36 to $2.53/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures fell 0.5%, but did so in an upside session – consistent with our neutral/bearish bias which we maintain. Slow stochastics crossed bullishly in neutral territory, the MACD and candlesticks are neutral, while the RSI continues to point lower. We continue to see nearby support at the 9-day ma ($1.4814) and then down at $1.4000, while $1.5198 and $1.5500 are expected to offer resistance. RBOB futures edged down 0.2% in an upside session – printing a Doji star shaped candlestick. Slow stochastics and the RSI are neutral, along with candlesticks, while the MACD points higher. We are going to remain neutral/bearish for now, still seeing nearby support at the 18-day ma ($1.3137), followed by $1.2008, whereas $1.3899 and $1.4913 are seen offering resistance. WTI futures edged up 0.2% in an upside session today. Stochastics, the RSI, the MACD, and candlesticks are all neutral now, so we remain on the sidelines. We continue to see nearby resistance at $49.28 and then up at $52.17, with the 9-day ma ($47.89 – tested today) and $45.27 as support levels. Finally, natural gas futures dropped 3.5% in a downside session – not so consistent with our neutral bias. Bears took out 100-day ma ($2.598) support, which now becomes nearby resistance followed by $2.762, whereas $2.527 and $2.403 are expected to offer support. We are going to side with the bears now as slow stochastics, the RSI, and candlesticks all point lower, while the MACD is neutral.