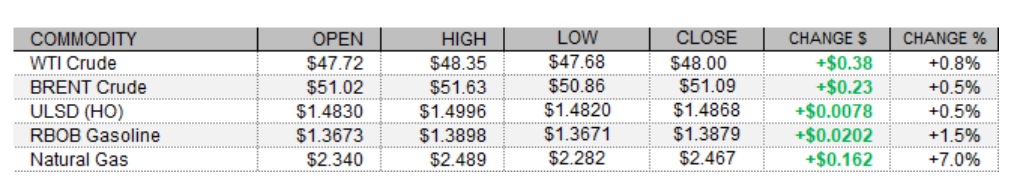

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

Petroleum futures turned back north in a thin-volume trading session today amid weakness in the US dollar and mostly higher trade in European equities, despite losses in US shares. There was little on the newswires today. The US House of Representatives voted to meet the President’s demand for an increase in COVID-19 relief checks from $600 to $2,000. The Senate still needs to vote on the measure. In economic news, the S&P CoreLogic Case-Shiller Home Price Index rose 1.6% in October, above the Econoday consensus at 0.7%. European shares closed mixed today with the DAX down 0.2%, while the CAC 40 rose 0.4% and the FTSE 100 added 1.6%. US stock market index futures were seeing losses of between 0.2% (S&P 500) and 0.3% (Dow, Nasdaq) as of this writing. In supportive news, the US dollar index was down 0.3%.

Forward Curves (ULSD | RBOB | NAT GAS) & DISTILLATE STOCKS US

NATURAL GAS | WEATHER | INVENTORIES

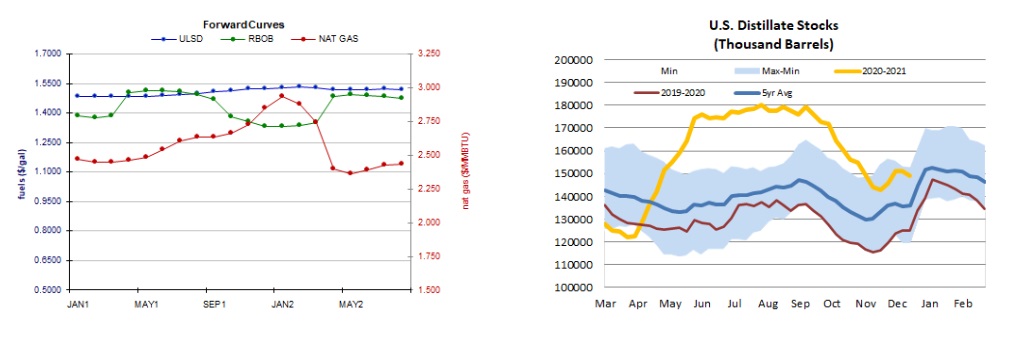

Natural gas futures rallied today despite a weaker two-week heating degree day forecast and a looser market balance expectation for next week. Refinitiv analysts now see total US demand of 119.0bcf/d outpacing US supply at 99.9bcf/d next week, implying smaller withdrawals of 19.1bcf/d (compared to yesterday’s forecast at 20.7bcf/d). The Global Forecast System cut its heating degree day forecast for the next two weeks from 387 to 375, which is well below to the 30-year average of 460, but closer to last year's 350 HDDs over the same period. The latest 1-5, 6-10, and 11-15 day outlooks (EC) see above-normal temperatures in both the Northeast and the Midwest. In the cash market today, prices at the Henry Hub benchmark fell from $2.58 to $2.39/mmBtu and Transco Zone 6 prices in New York dropped from $2.84 to $2.43/mmBtu, while Algonquin citygate prices rose from $3.87 to $3.90/mmBtu. According to a Reuters poll of analysts, estimates for the weekly EIA petroleum inventory report for the week ended December 25 call for a 2.6mb draw from US crude stocks amid a 0.6 percentage point predicted increase in the nation’s refinery utilization rate. Distillate stocks are expected to rise by 0.5mb and gasoline stockpiles are expected to increase by 1.7mb. API petroleum inventories for the same week are due this afternoon at 4:30.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures edged up 0.5% today in a thinly-traded inside session, settling just north of the 9-day ma ($1.4864) - which remains nearby support followed by $1.4000. We see nearby resistance at the recent $1.5198 high and then up at $1.5500, and maintain our neutral/bearish view for now, although there does appear to be a narrowing wedge-shaped pattern developing in the candlesticks from the last six sessions. RBOB futures added 1.5% in an inside session today, making a try for $1.3899 resistance but settling below this level, which we continue to keep an eye on with $1.4913 seen offering resistance after that. We'll stick to our flat-to-lower price view for the moment, seeing support at the 18-day ma ($1.3301) and then down at $1.2008. WTI futures added 0.8% in an inside session, consistent with our neutral stance. Futures settled right at the 9-day ma ($48.00) which is our nearby support/resistance level, with $49.28 above and $45.27 and then $42.02 below. Finally, natural gas prices rebounded today, climbing 7.0% higher in an upside session in a manner inconsistent with our downside view. Slow stochastics are narrowing near the oversold boundary but have yet to cross. Meanwhile, the RSI is fairly neutral, as the major averages. Bulls managed to take out $2.403 resistance, and we look next to the 100-day ma ($2.602) for resistance, with support at $2.403 and then $2.258. We'll stick to our (bearish) guns for now.