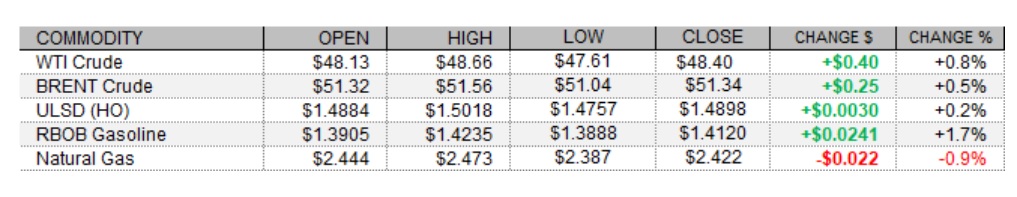

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

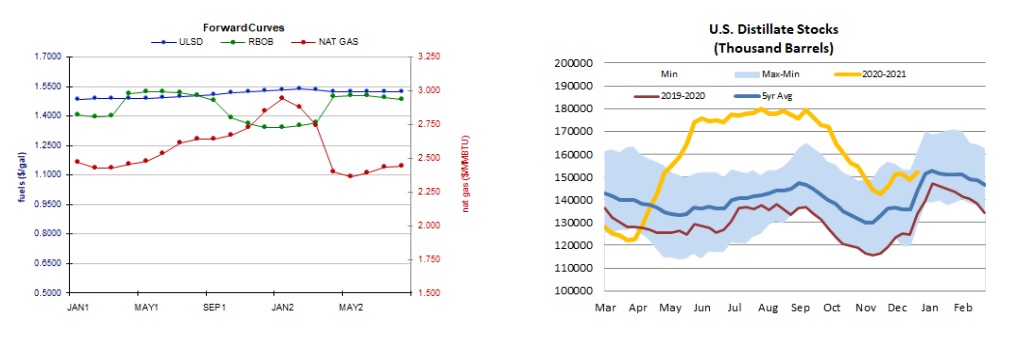

Petroleum futures saw see-saw (and again very thin) trade today, with most of the complex spending much of the session north of the unchanged mark amid fresh multi-year lows in the US dollar, strength in US equities (despite weakness in Europe) and following a mostly bullish weekly inventory report from the Energy Information Administration. The agency reported a draw of twice the expected size from commercial crude oil inventories. The gasoline crack widened amid bullish weekly gasoline stock data - showing a surprise draw - while the ULSD crack narrowed following bearish data for distillates. It was a quiet day on the economic calendar. The FTSE 100 fell back 0.7%, the DAX lost 0.3%, and the CAC 40 shed 0.2%. Meanwhile, US shares were seeing gains as of this writing, with the Dow up 0.5%, the Nasdaq up 0.4%, and the S&P 500 having gained 0.3%. Also supportive for crude oil prices, the US dollar index was down 0.35% and saw its weakest levels since the spring of 2018 intraday. In unsupportive supply-side news, the Baker Hughes rig count report (released early due to the holiday on Friday) showed the US rig count rose by 3 to 267 last week.

Forward Curves & US Distillate Stocks

NATURAL GAS | WEATHER | INVENTORIES

Natural gas futures lost ground today with unsupportive shifts to the temperature outlook. The Global Forecast System trimmed its two-week HDD forecast by 3 to 372, well below the 30-year average of 461 and closer to last year's 351 HDDs. The latest 1-5 day outlook from the ECMWF sees above-normal temperatures in much of the Midwest and on the East Coast, and the 6-10 and 11-15 day forecasts call for above-normal temperatures across the eastern two-thirds of the country, with particularly high deviations above normal temperatures in the Midwest and in New England. Refinitiv cut its total US demand forecast for next week by 1.0bcf/d to 118.0bcf/d, while raising its supply forecast by 0.1bcf/d to 100.0bcf/d, implying smaller withdrawals from storage of 18.0bcf/d. Baker Hughes reported no change in the US natural gas rig count this week, holding at 83. In the cash market today, Henry Hub prices added one cent, reaching $2.40/mmBtu, while Transco Zone 6 prices in New York fell from $2.43 to $2.37/mmBtu and Algonquin citygate prices dropped down from $3.90 to $3.14/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures edged up 0.2% in a low-volume outside session today. Slow stochastics, the RSI, candlesticks, and the MACD are all neutral, and we are going to remain on the sidelines, awaiting further developments. We settled above the 9-day ma ($1.4876) which was tested today and we continue to see nearby support there and then down at $1.4000, while $1.5198 and $1.5500 are expected to offer resistance. RBOB futures added 1.7% in an upside session today with bulls taking out the $1.3899 resistance level. Slow stochastics are bullish but look set to cross the overbought line, and the RSI, the MACD, and candlesticks also point higher. We are now going to fall back onto the sidelines, awaiting further bullish confirmation. We now see nearby resistance at $1.4913 and then up at $1.5427, with $1.3899 and the 18-day ma ($1.3385) seen as nearby support levels. WTI futures rose 0.8% but did so in an outside session – consistent with our neutral bias which we maintain. Bulls took out the 9-day ma ($48.06) and we now see nearby resistance at $49.28 and then at $50.54, whereas $45.27 and $42.02 remain our support levels. NYMEX natural gas futures fell 0.9% in an inside session (lower high, higher low) – somewhat consistent with our bearish bias. We are going to stick with our bearish stance for a bit longer, still seeing nearby support at $2.403 (tested today) and then at $2.258, with the 100-day ma ($2.604) and $2.898 seen offering resistance.