PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

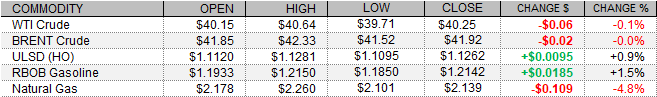

The complex saw see-saw trade about the unchanged mark today, settling mixed with crack spreads widening some. The US dollar index extended its rally today, likely weighing on oil futures prices, with the index hitting its strongest levels since July 24 at the highs. Trade in European equities likely also weighed, as the CAC 40 fell 0.7% and the DAX dropped 1.1% lower - although the FTSE 100 added 0.3%. Meanwhile, trade in US shares was supportive. Headline US durable goods orders for August disappointed, but details were encouraging. While orders growth of 0.4% fell short of consensus at 1.5%, July orders were revised up by 0.5pp to 11.7% and core capital goods orders growth of 1.8% beat expectations at 1.7% - even after a large upward revision of 0.6pp to 2.5% in July orders growth. As of this writing, the Dow was up 0.7%, the S&P 500 had gained 1.0%, and the Nasdaq was the leading the way higher with a 1.6% jump. News on the supply side today was unsupportive, as Baker Hughes reported a rise of 4 in the US oil rig count, to 183.

NATURAL GAS | WEATHER | INVENTORIES

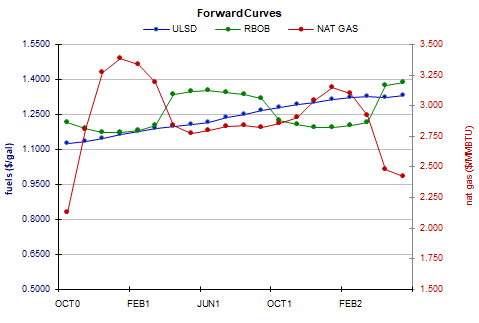

Natural gas futures pulled back some today after a rally over the past two sessions, with a looser market forecast for next week and a rise in the rig count. Refinitiv analysts cut their total US supply forecast for next week by 0.5bcf/d to 90.9bcf/d, but cut their demand forecast further - by 0.7bcf/d to 84.6bcf/d, implying slightly larger injections of 6.3bcf/d. For the next two weeks, the Global Forecast System sees 150 degree days, compared to 149 in the previous forecast. Cooling degree days were revised down from 91 to 82, but heating degree days were revised up from 58 to 68. In unsupportive supply side news, Baker Hughes reported an increase of 2 in the US natural gas rig count, to 75. This is still 71 lower than last year during the same week. Cash market prices generally weakened today. Prices at the Henry Hub benchmark fell from $1.74 to $1.49/mmBtu, Transco Zone 6 prices in New York fell from $1.28 to $1.17/mmBtu, and Algonquin citygate prices slipped from $1.42 to $1.30/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

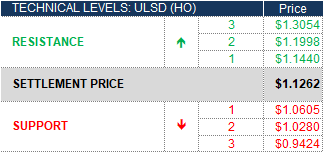

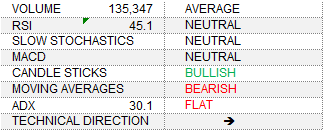

ULSD futures rose 0.9% in an upside session today, and with futures trending slightly higher for three sessions, we'll fall back to the sidelines. There was no real threat to nearby 100-day ma resistance ($1.1440) and we'll continue to keep an eye up there and then up at the 50-day ma ($1.1998), whereas the recent $1.0605 low and then the $1.0280 level (23.6% Apr-Aug) are our nearby support levels. RBOB futures also continued higher, and bulls made a stronger showing, taking us 1.5% higher and up through nearby 200-day ma resistance ($1.2059), also causing slow stochastics to cross in neutral territory. We'll drop to the sidelines, looking to the 50-day ma ($1.2293) and then to $1.2546 for (61.8% Jan-Mar) for resistance, whereas the 200-day ma and then $1.0861 are seen offering nearby support. WTI futures edged down 0.1% in an upside session, consistent with our neutral stance, which we maintain. Nearby resistance remains at $41.49, followed by $45.27, whereas the 200-day ma ($39.75) and then the 100-day ma ($38.48) are nearby support. Natural gas futures fell back today, slipping 4.8% lower in a downside session, inconsistent with the bullish stance we adopted yesterday. Although today's candlestick was disheartening, stochastics remain bullish, the MACD is narrowing towards a bullish cross, and major averages continue to point higher. We'll stick to our guns for now, seeing resistance at the 50-day ma ($2.185) and then at $2.403, whereas the 9-day ma ($2.100) and then the 200-day ma ($1.933) are nearby support.