The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

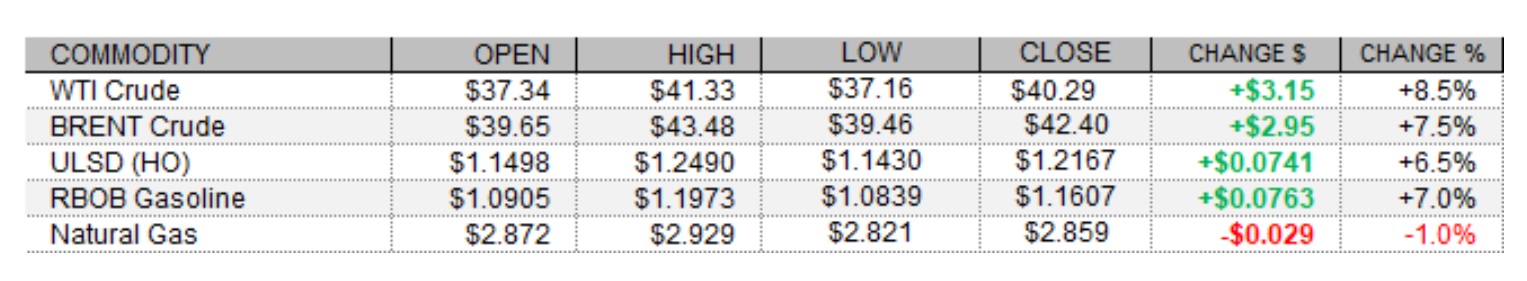

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

Petroleum futures rallied today, led by WTI, amid news of a progress in COVID-19 vaccine trial, a possible extension of OPEC+ production cuts, and gains in US and European equities, despite strength in the US dollar. Reuters reported that a Pfizer’s experimental vaccine has been 90% effective in preventing COVID-19, based on initial data from a large study. In more supportive news, Saudi Arabia’s Energy Minister said that OPEC+ deal could be adjusted if there is a consensus among the group’s members. European shares saw a rally today with the FTSE 100 adding 4.7%, the DAX climbing 4.9% higher, and the CAC 40 jumping 7.6%. As of this writing, US stock market indexes were seeing gains of between 0.6% (Nasdaq) and 4.7% (Dow). The US dollar index turned back north today after a four-session slide and was up 0.7%.

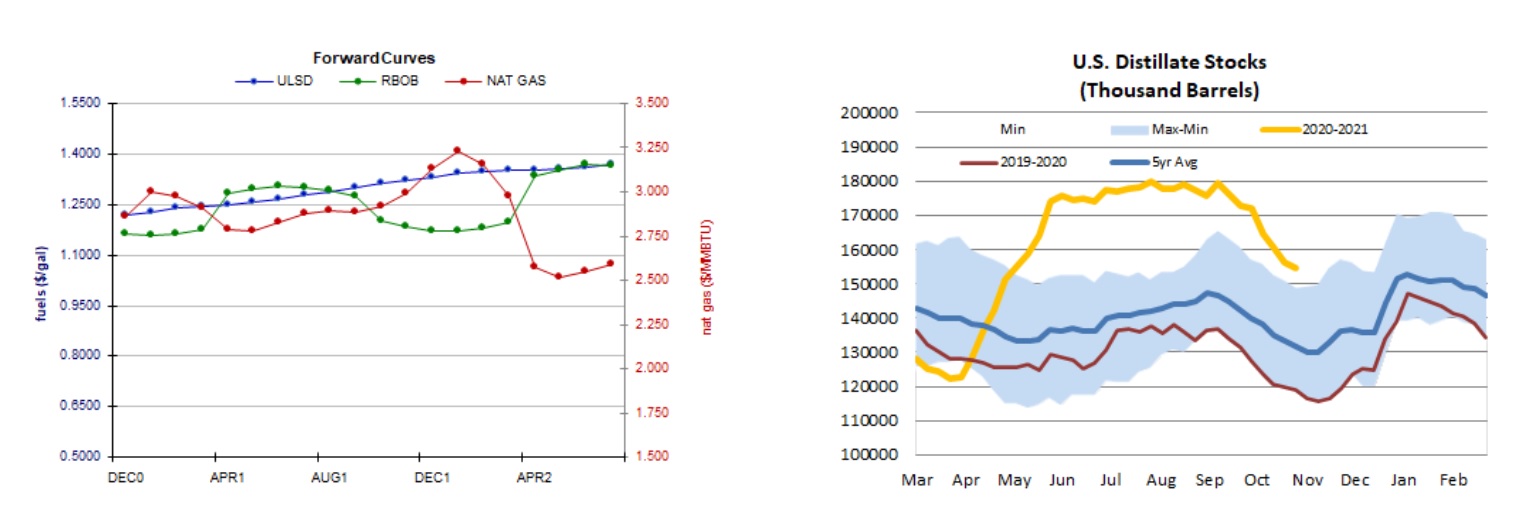

NATURAL GAS | WEATHER | INVENTORIES

Natural gas futures weakened further today amid a looser market balance expectation for this week and an unsupportive weather outlook, despite an upward revision to the two-week heating degree day forecast. For this week, Refinitiv analysts trimmed their total US demand forecast by 0.2bcf/d to 91.6bcf/d and cut their total US supply forecast by 3.2bcf/d to 93.5bcf/d, implying smaller injections of 1.9bcf/d (compared to 5.2bcf/d previously). Next week, supply is expected to rise to 95.3bcf/d and demand is seen jumping to 99.3bcf/d. The Global Forecast System raised its two-week heating degree day forecast from 192 to 216, which is still well below both the 30-year average of 278 and last year's 294 HDDs during the same period. The latest 1-5 day outlook (ECMWF) sees mixed temperatures in the Midwest, but well above-normal temperatures on the East Coast. The 6-10 and 11-15 day forecasts are less supportive with above-normal temperatures expected across the eastern half of the country. In the cash market today, prices at the Henry Hub benchmark fell from $2.69 to $2.67/mmBtu, Transco Zone 6 prices in New York fell from $0.51 to $0.20/mmBtu, and Algonquin citygate prices dropped from $0.78 to $0.45/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures added 6.5% in an upside session today – consistent with our bullish bias. Bulls took out both the 200-day ma ($1.1706) and the 100-day ma ($1.1859) resistance levels, which now become our nearby support, while $1.2490 (today’s high) and $1.3000 are our new resistance levels. Slow stochastics have crossed bearishly in overbought territory, while the RSI and candlesticks are bullish, and the MACD is neutral. We are going to continue to favor upside chances for a bit longer, noting that a retracement could be possible after a jump of this magnitude. RBOB futures rallied 7.0% in an upside session today with bulls taking out the 200-day ma ($1.1263) resistance level along the way. The 200-day ma becomes our nearby support, followed by $1.0000, whereas $1.1973 (today’s high) and the 100-day ma ($1.2081) are expected to offer resistance. We are going to remain on the sidelines for now, noting that a retracement could be possible in the next session. WTI jumped 8.5% in an upside session – not consistent with our neutral bias. Stochastics crossed for a sale signal and are leaving overbought territory, while the RSI points higher, and the MACD is neutral now. We are going to remain neutral for now, still seeing nearby support at the 200-day ma ($36.62) and then down at $32.64, whereas $41.49 and $45.27 are seen offering resistance. Finally, natural gas futures settled 1.0% in a downside session – consistent with our bearish bias which we maintain. We continue to see nearby support at $2.762 and then down at $2.403, with $2.898 and $3.182 expected to offer resistance.