The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

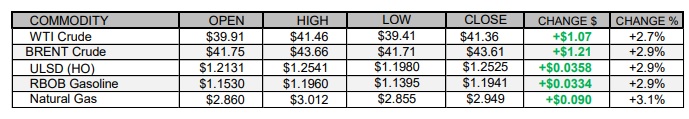

Petroleum futures continued higher today amid gains in European equities, despite mixed but mostly lower trade in US shares and a bearish revision to the 2020 global oil demand forecast in the EIA's Short-Term Energy Outlook. The EIA released its November STEO today, in which it estimates that global consumption of petroleum and liquid fuels will average 92.9mb/d for 2020, down by 8.6mb/d from 2019, before increasing by 5.9mb/d in 2021. The EIA sees US oil production falling by 860kb/d to 11.39mb/d this year, a bigger decline than its previous forecast calling for an 800kb/d drop. US oil output is seen falling by another 290kb/d to 11.1mb/d in 2021. In economic news, the Labor Department’s JOLTS report showed 6.436m job openings in September, below expectations at 6.508m. Additionally, August openings were revised down from 6.493m to 6.6.352m. European shares closed higher today with the DAX up 0.5%, the CAC 40 adding 1.6%, and the FTSE 100 gaining 1.8%. US stock market indexes were trading mixed as of this writing, with the S&P 500 down 0.6% and the Nasdaq having dropped 1.6%, while the Dow was up 0.3%. The US dollar index was trading flat as of this writing.

NATURAL GAS | WEATHER | INVENTORIES

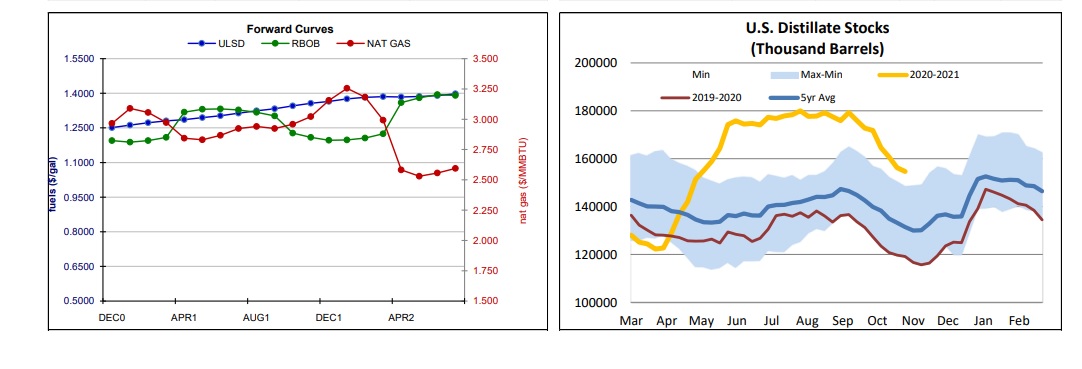

Natural gas futures turned back north today amid a stronger two-week heating degree day forecast and a tighter market balance expectation for next week. The Global Forecast System raised its heating degree day forecast from 216 to 237 for the next two weeks, which is still well below both the 30-year average of 284 and last year's 341 HDDs over the same period. Refinitiv analysts now see total US demand of 101.4bcf/d outpacing US supply at 94.9bcf/d next week, implying larger withdrawals of 6.5bcf/d (compared to yesterday’s forecast at 4.0bcf/d). In the cash market today, prices at the Henry Hub benchmark fell from $2.67 to $2.63/mmBtu, while Transco Zone 6 prices in New York rose from $0.20 to $0.42/mmBtu and Algonquin citygate prices rose from $0.45 to $0.53/mmBtu. The latest 1-5 day forecast (EC) sees well above-normal temperatures on the East Coast and mixed temperatures in the Midwest. The 6-10 and 11-15 day outlooks are unsupportive with mostly above-normal temperatures expected across the eastern half of the country. According to a Reuters poll of analysts, estimates for the weekly EIA petroleum inventory report for the week ended November 6 call for a 0.9mb draw from US crude stocks and a 0.5 percentage point predicted increase in the nation’s refinery utilization rate. Distillate stocks are expected to fall by 1.9mb and gasoline stockpiles are expected to decrease by 0.3mb. API petroleum inventories for the same week are due this afternoon at 4:30.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures rose 2.9% in an upside session today – consistent with our bullish bias which we continue to maintain. Bulls took out $1.2490 resistance level and we now look at $1.3000 and then up at $1.3054 for resistance, while the 100-day ma ($1.1863) and the 200-day ma ($1.1682) are expected to offer support. RBOB futures added 2.9% in an inside session today – consistent with our neutral stance. We remain neutral for now, still seeing nearby resistance at $1.1973 (yesterday’s high), followed by the 100-day ma ($1.2073), with the 200-day ma ($1.1248) and $1.0000 seen as nearby support levels. WTI futures settled 2.7% higher in an upside session today with bulls taking out the 100-day ma ($40.36). Slow stochastics and the MACD are neutral, while the RSI and candlesticks point higher. We are going to side with the bulls again, still seeing nearby support at the 200-day ma ($36.56) and then down at $32.64, with $41.49 and $45.27 as nearby resistance levels. NYMEX natural gas futures rose 3.1% in an upside session today – inconsistent with our bearish bias. Slow stochastics have crossed bullishly in the oversold territory and the RSI also points higher, while the MACD is neutral. However, we are going to stick to our bearish bias for a bit longer, awaiting further developments. Bulls managed to take out $2.898 resistance level, which now becomes nearby support along with $2.762, while $3.182 and $3.396 (recent high) are expected to offer resistance.