The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

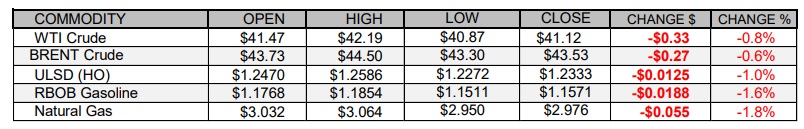

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

Petroleum futures weakened today amid losses in European and US equities, an unsupportive comment from the IEA regarding the 2021 global oil demand forecast, and bearish US crude oil inventory data from the EIA. The EIA reported a 4.28mb build in commercial crude stocks, against expectations calling for a 1.96mb draw. Data for gasoline and distillates were supportive as the agency reported larger than expected draws from both gasoline and distillates stockpiles. The International Energy Agency (IEA) said that global oil demand will unlikely to see any significant boost from the COVID-19 vaccine until well into 2021. In US economic news today, weekly initial jobless claims fell from an upwardly-revised 757,000, past the Econoday consensus at 737,000, to 709,000. Consumer price inflation (as measured by the CPI) remained unchanged last month, while expectations called for a 0.2% rise. Core prices also remained steady, while forecasts called for a 0.2% increase. US stock market indexes were seeing losses of between 0.7% (Nasdaq) and 1.3% (Dow), as of this writing. European shares closed in the red today with the FTSE 100 down 0.7%, the DAX losing 1.2%, and the CAC 40 dropping 1.5%. The US dollar index was trading flat, as of this writing.

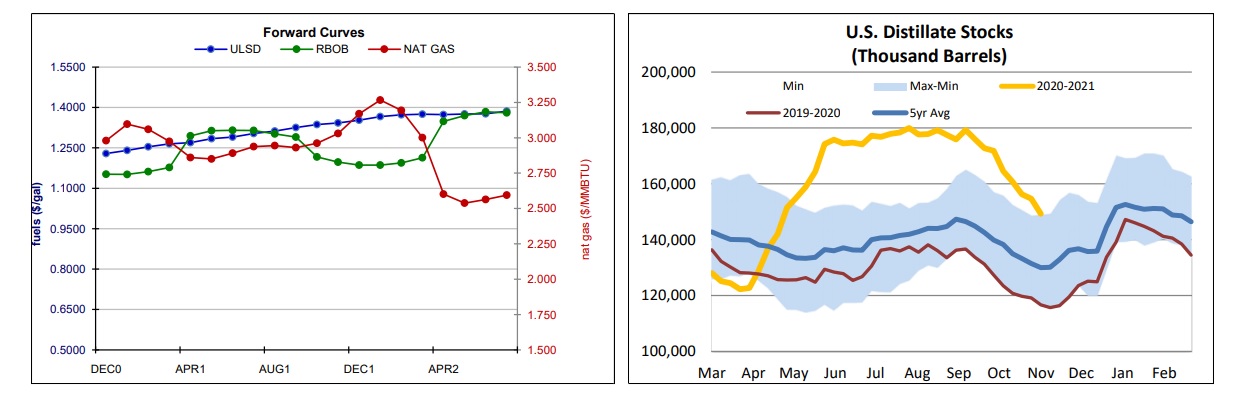

NATURAL GAS | WEATHER | INVENTORIES

Natural gas futures fell today despite a tighter market balance expectation for next week and a stronger two-week heating degree day forecast. Refinitiv analysts now see total US demand of 104.6bcf/d outpacing US supply at 94.8bcf/d next week, implying larger withdrawals of 9.8bcf/d (compared to yesterday’s forecast at 8.0bcf/d). The Global Forecast System raised its heating degree day forecast by 4 to 249 for the next two weeks, which is well below both the 30-year average of 295 and last year's 341 HDDs over the same period. The latest 1-5 day outlook (EC) continues to see above-normal temperatures on the East Coast, while mixed temperatures are expected in the Midwest. The 6-10 day forecast calls for below-normal temperatures on the East Coast, while mostly above-normal temperatures are seen in the Midwest. In the cash market today, prices at the Henry Hub benchmark rose slightly from $2.74 to $2.75/mmBtu, Transco Zone 6 prices in New York rose from $1.15 to $1.48/mmBtu, and Algonquin citygate prices jumped from $1.08 to $1.55/mmBtu. Due to the holiday on Wednesday, the EIA is due to release its weekly natural gas storage report tomorrow for the week ended November 6, and analysts polled by Reuters see a 9bcf withdrawal being reported. This would be in contrast to the 33bcf five-year average injection and also last year's 12bcf rise in storage levels.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures edged down 1.0% in a downside session today – inconsistent with our bullish bias. Slow stochastics are bearish now, while the RSI is neutral, and the MACD is bullish. We are going to fall on the sidelines, still seeing nearby support at the 100-day ma ($1.1869), followed by the 200-day ma ($1.1639), while $1.3000 and $1.3054 are expected to offer resistance. RBOB futures fell 1.6% in a downside session today. Slow stochastics and the RSI point lower, while the MACD is neutral, so we are going to take a neutral/bearish stance now. We continue to see nearby support at the 200-day ma ($1.1214) and then down at $1.0000, while $1.1973 and the 100-day ma ($1.2048) are seen offering resistance. WTI futures, where we were bullish, settled 0.8% lower in a downside session. Technical indicators are mostly neutral, so we are going to fall back on the sidelines, still seeing nearby resistance at $41.49 and then up at $45.27, with the 200-day ma ($36.44) and $32.64 as nearby support levels. Lastly, natural gas futures fell 1.8%, but did so in an upside session – not too consistent with our bullish bias. Stochastics point higher, while the RSI and the MACD are neutral. We are going to continue to favor upside chances for a bit longer, still looking at $3.182 and then $3.396 for resistance, while $2.898 and $2.762 are expected to offer support.