The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

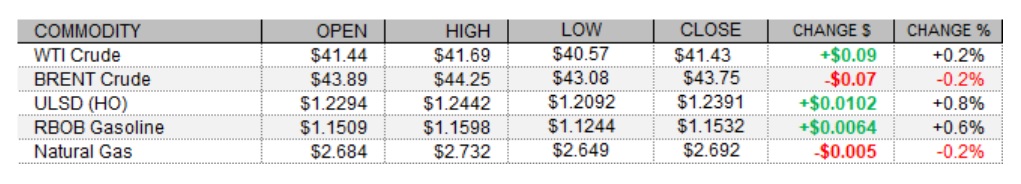

Crude futures settled mixed near the unchanged mark today with weakness in the US dollar and news of the possibility of tighter OPEC+ supply policies supporting, while losses in US shares were unsupportive. Reuters reported that Saudi Arabia called on fellow OPEC+ members to be flexible in responding to oil market needs, in an attempt to build a case for a policy of tighter oil production in 2021. OPEC+ is considering delaying its current plan to boost output by 2mb/d starting in January, in order to support the market. OPEC+ held a ministerial committee meeting today but the committee made no formal recommendation. The OPEC+ group is set to meet on November 30 and December 1. In economic news, US retail sales for October were a miss, with sales growth of 0.3% falling short of consensus at 0.4%, and September sales growth was revised down by 0.3pp to 1.6%. On the other hand, US industrial production rose 1.1% last month, above expectations at 1.0%. The NAHB US Housing Market Index for November was a beat, coming in at 90 - up from 85 last month and beating expectations calling for no change. Also supportive, Canadian housing starts rose from a downwardly-revised 208,715 annualized pace in September to 214,875 in October, above expectations at 205,000. European shares closed mixed today with the CAC 40 up 0.21%, while the DAX edged down 0.04% and the FTSE 100 closed 0.87% lower. As of this writing, US stock market indexes were seeing losses of between 0.05% (Nasdaq) and 0.57% (Dow). The US dollar index was down 0.22%, which is supportive for crude oil prices.

NATURAL GAS | WEATHER | INVENTORIES

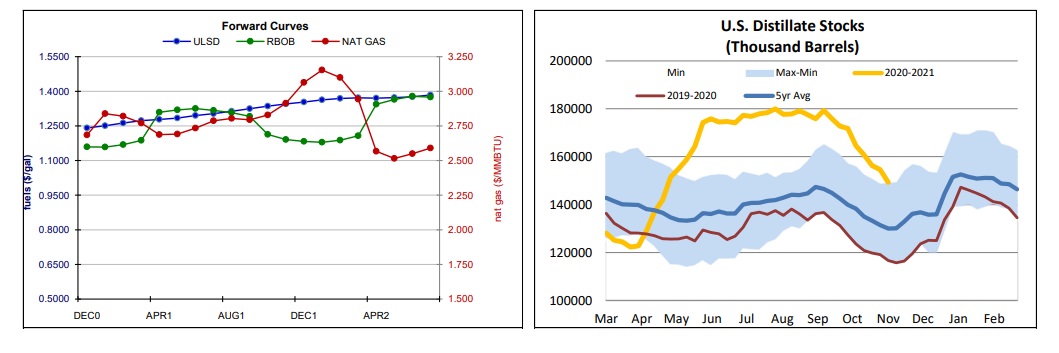

Natural gas futures see-sawed near the unchanged mark today with a tighter market balance expectation for next week and a stronger two-week heating degree day forecast likely supporting, while weather outlooks were unsupportive. Refinitiv analysts now see total US demand of 99.6bcf/d outpacing US supply at 97.9bcf/d next week, implying withdrawals of 1.7bcf/d (compared to yesterday’s forecast calling for a 0.8bcf/d injection). The Global Forecast System raised its heating degree day forecast for the next two weeks from 259 to 162, which is well below both the 30-year average of 324 and last year's 311 HDDs over the same period. The latest 1-5 day forecast (EC) sees above-normal temperatures in the Midwest but mostly below-normal temperatures in the Northeast. The 6-10 and 11-15 day outlooks are unsupportive, with above-normal temperatures expected across the eastern half of the country. In the cash market today, prices at the Henry Hub benchmark fell from $2.82 at $2.62/mmBtu, while Transco Zone 6 prices in New York rose from $1.64 to $2.35/mmBtu and Algonquin citygate prices jumped from $2.03 to $3.07/mmBtu. According to a Reuters poll of analysts, estimates for the weekly EIA petroleum inventory report for the week ended November 13 call for a 1.7mb rise in US crude stocks and a 0.6 percentage point predicted increase in the nation’s refinery utilization rate. Distillate stocks are expected to fall by 1.5mb, while gasoline stockpiles are expected to increase by 0.1mb. API petroleum inventories for the same week are due this afternoon at 4:30.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures edged up 0.8% today, but in a thinly-traded inside session (lower high, higher low) - and so we will stick with our downside bias for now. At the same time, we note that the 9-day ma is up above the 100-day ma now, and the 18-day ma has crossed up and over the 200-day ma as well. We look to $1.3054 (August high) for resistance, followed by $1.3500, whereas the aforementioned 100-day ma ($1.1892) and then 200-day ma ($1.1583) are seen offering nearby support. RBOB futures edged up 0.6% in an inside session, settling not far from the open for a hammer-shaped candlestick. Slow stochastics point south, but the RSI is neutral, as are the MACD and major averages. We'll stick with the bears for the moment, seeing 200-day ma ($1.1165) and then $1.0310 support, whereas the 100-day ma ($1.2036) and then $1.2546 are expected to offer nearby resistance. WTI edged up 0.2%, also in an inside session, and also printing a hammer-shaped candlestick. We continue to favor the downside for now seeing $43.78 (August high) and then $45.27 resistance, with 100-day ma ($40.45) and then 200-day ma ($36.30) support. Natural gas futures were also little changed today, edging down 0.2% in a downside session, testing the 50-day ma ($2.663) - but settling above it. This was consistent with the neutral stance we adopted yesterday, and which today's action gave us no reason to depart from. We continue to see support at the 50-day ma and then down at $2.403, whereas $2.762 and then $2.898 are our nearby resistance levels.