The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

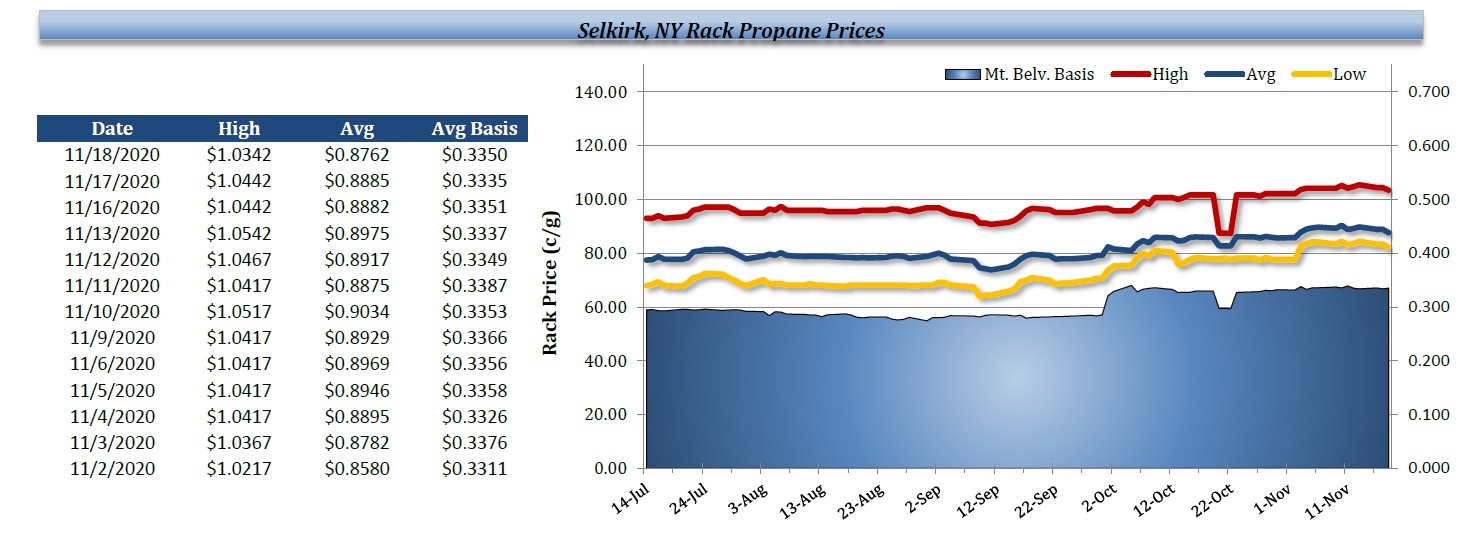

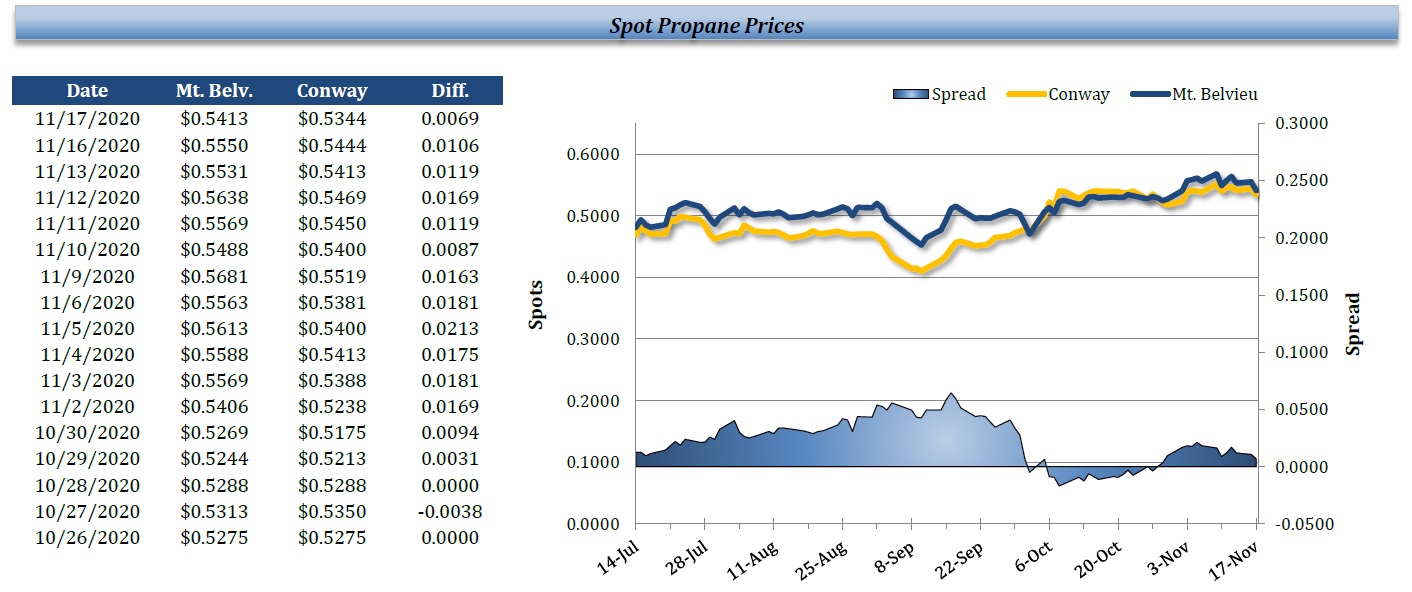

Propane prices fell on Tuesday, exhibiting independent weakness as crude oil and NYMEX natural gas futures were little changed. Brent crude edged down 0.2%, while WTI crude edged up. Weakness in the US dollar was supportive, as was talk that OPEC+ could extend the current level of output cuts beyond January, whereas weakness in US equities and the lack of any policy recommendation from the JMMC were unsupportive. Mt. Belvieu TET propane prices fell 2.5% (1.38 cents) to 54.13c/g and Conway prices dropped 1.8% (one cent) lower to 53.44c/g. Natural gas futures edged down just 0.2%.

Petroleum futures were strengthening this morning along with US and European shares, following encouraging news that Pfizer's final coronavirus vaccine trial results showed even stronger efficacy than previously estimated. Also supportive for crude was unrest in Nigeria. As of this writing, WTI futures were up 0.8% and Brent crude futures had gained 1.6%. Propane prices were falling slightly ahead of the weekly EIA inventory report this morning. Mt. Belvieu TET prices were off 0.1% (6 points) at 54.06c/g (non-TET close by at 53.94c/g) and Conway spots had shed 0.6% (31 points) to hit 53.13c/g.

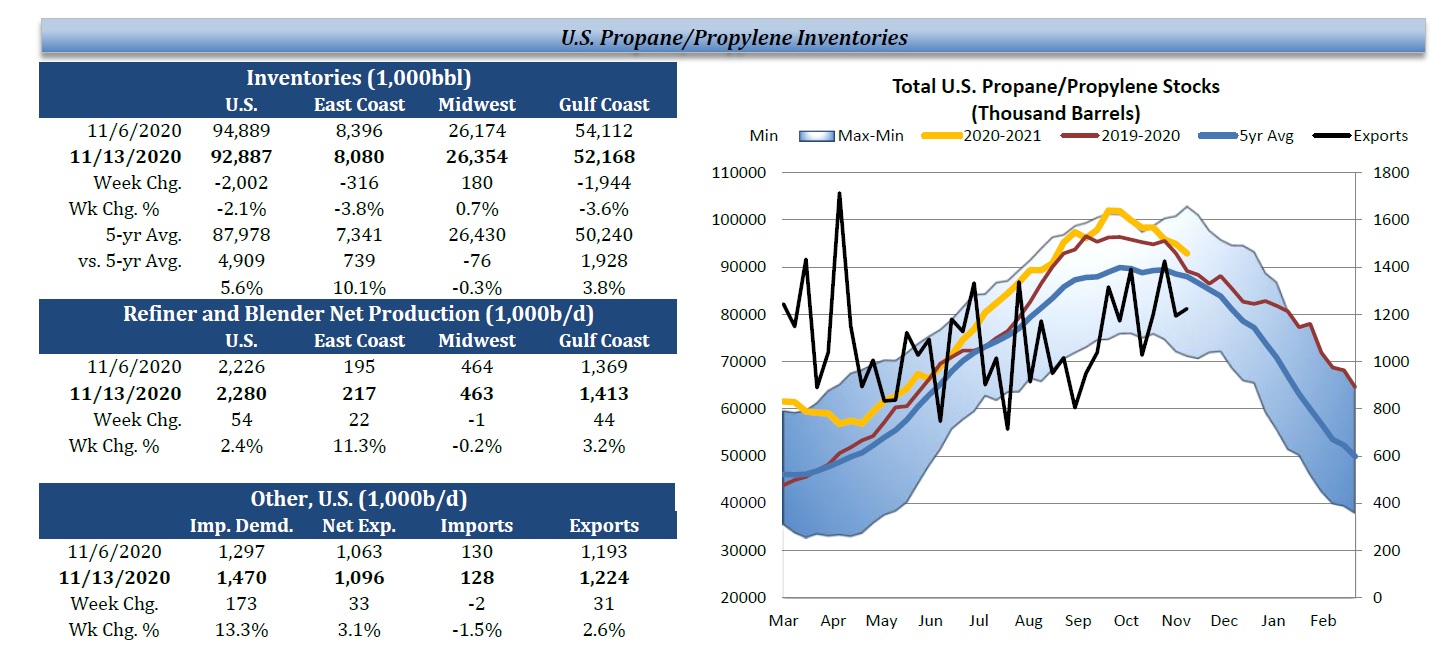

The weekly inventory report released this morning by the EIA was supportive for propane, as surveys conducted by both OPIS and Clarksons put expectation for the weekly stock change at a 1.3mb draw, whereas the agency reported a 2.0mb stock decline. The larger than expected drop during the week ended November 13 came as implied demand and exports strengthened, with a little additional help from marginally slower imports, while production increased. Implied demand averaged 13.3% (173kb/d) stronger last week, at 1.47mb/d, and net exports increased by 3.1% (33kb/d), averaging 1.10mb/d. Production increased by 2.4% (54kb/d) to a 2.28mb/d average. Gulf Coast stocks dropped by 1.94mb to 52.17mb, which is just 3.8% above the five-year average. Midwestern inventories saw a welcome 0.18mb build, and are now just 0.3% below their five-year average. East Coast stocks shed 0.32mb and are 10% above their historical average. US stocks overall are 5.6% above their five-year average and 4.2% stronger than last year.