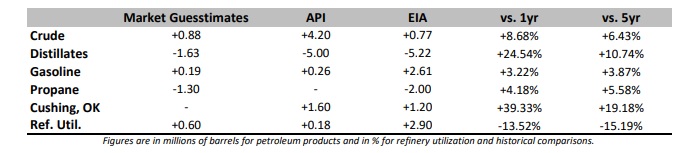

The Weekly Petroleum Status Report for the week ended November 13 was bullish for distillates, but neutral for crude oil and bearish for gasoline. The Energy Information Administration (EIA) reported a much larger than expected drop in distillate stock levels, but an as-expected uptick in crude oil inventories and a stronger than expected build in gasoline stockpiles. Following the report's release, the ULSD crack widened and the gasoline crack narrowed, consistent with the data. WTI crude futures were continuing to see modest gains as of this writing.

US commercial crude oil inventories rose by 0.77mb last week, very closely in-line with expectations calling for a 0.88mb build. The rise came as production rebounded, even as refinery runs picked up and import activity waned. The rise was seasonal, but sufficient to keep stock levels right by the top of the five-year range for the reporting week. According to the seasonal trend, stock levels should turn south here shortly, falling through mid-January as refining operations typically pick back up this month, before turning lower once again early next month. Stock levels at the Cushing, OK storage hub also rose last week, by 1.20mb to 61.61mb. This was also seasonal, as the five-year average calls for stock levels to turn lower around mid-December, but increases over the past two months have been larger than normal - widening the surplus over the five-year average to 19.2% (and the surplus over last year's relatively weak levels to 39.3%). US inventories, at 489.48mb, are 6.4% higher than their five-year average and 8.7% above last year's levels.

US oil production jumped 0.40mb/d higher last week, hitting 10.90mb/d. This is still, however, 1.90mb/d lower than last year and 2.20mb/d lower than the spring peak. The increase this latest reporting week was entirely driven by output from the Lower 48 states. However, virtually all of the increase was offset by a 0.39mb/d jump in refinery runs, which averaged 13.84mb/d last week. Runs have been rising from October 18, by 0.81mb/d, which follows the seasonal trend. Runs typically rise by 1.6mb/d from the October through the late-December peak. The forward path for refining activity could vary depending on the course the coronavirus takes and the response from various levels of government over the winter. Some localities have been tightening restrictions, but largely to a much lesser degree than earlier this year.

Distillate stockpiles continued their rapid plunge last week, dropping 5.22mb to 144.07mb on stronger implied demand, even as imports picked up as well. Implied demand strengthened by an average of 0.17mb/d last week, averaging 4.23mb/d and just 0.10mb/d lower than last year despite the pandemic. Exports were steady at 1.08mb/d, but this is still 0.18mb/d lower than last year. Imports, meanwhile, picked up by 0.15mb/d to average 0.29mb/d - about flat to last year. Production rose marginally to 4.28mb/d, but his is 0.85mb/d lower than last year. There is increasing talk that overall US refining capacity could fall or stall over the next year or so. US distillate stocks have fallen from a sky-high 179mb back in September to 144.07mb as of this latest reporting week - a drop of over nineteen percent. This has also left stock levels back within the weekly five-year range - but still 10.7% above the five-year average for the week and 24.5% stronger than last year. Stocks typically are rising at this time of the year, as production increases seasonally. Either way, for now there is still a solid inventory cushion and we have seen this reflected in soft New York Harbor barge differentials to spot NYMEX, charted above.

Gasoline stock levels increased by 2.61mb last week, topping the 0.19mb rise predicted by analysts. The build was helped along by a fairly sharp 0.50mb/d drop in implied demand, which averaged 8.26mb/d and 0.93mb/d lower than last year. Implied demand had been within the weekly five-year range the prior reporting week, but has fallen back down and out of it. The build came despite a 0.26mb/d drop in production, which averaged 9.06mb/d or 0.99mb/d lower than last year. Stock levels on the East Coast increased by 0.81mb to 62.60mb. Both US and East Coast inventories are healthy compared to historical levels. PADD 1 stocks are over seven percent stronger than both last year and the five-year average, and US stocks overall enjoy surplus of over three percent over both last year and their five-year average. Stocks typically rise from now until mid-February, with rising refining activity and waning demand as temperatures fall as well.

Combined propane and propylene stocks fell by 2.0mb last week, a slightly larger than expected drop as surveys conducted by both OPIS and Clarksons put expectations at a 1.30mb draw. The drop came as implied demand and net exports strengthened, while an increase in production helped to limit its size. Implied demand jumped 13.3% higher to average 1.47mb/d, which is well above last year's 1.39mb/d during the same reporting week. Net exports picked up by 3.1mb/d to 1.10mb/d, but this is lower than last year's 1.23mb/d. On the other side of the equation, production increased by 2.4% to 2.28mb/d last week, well above last year's 2.13mb/d. Gulf Coast stocks dropped 1.94mb lower to 52.17mb last week, cutting the surplus over the five-year average down to just 3.8%. Midwestern inventories, meanwhile, saw a welcome 0.18mb rise and a trim the deficit to the five-year average down to just 0.3%. East Coast stocks fell by 0.32m last week, but at 8.08mb are still 10% above their five-year average. US stocks overall remain in strong shape.