The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

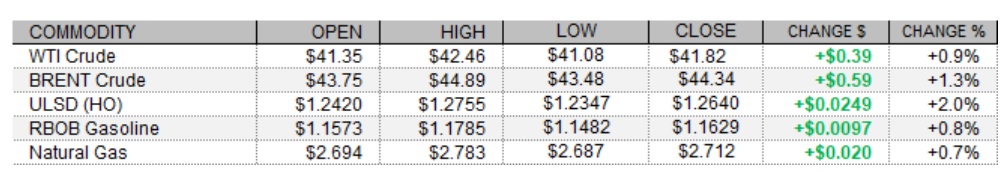

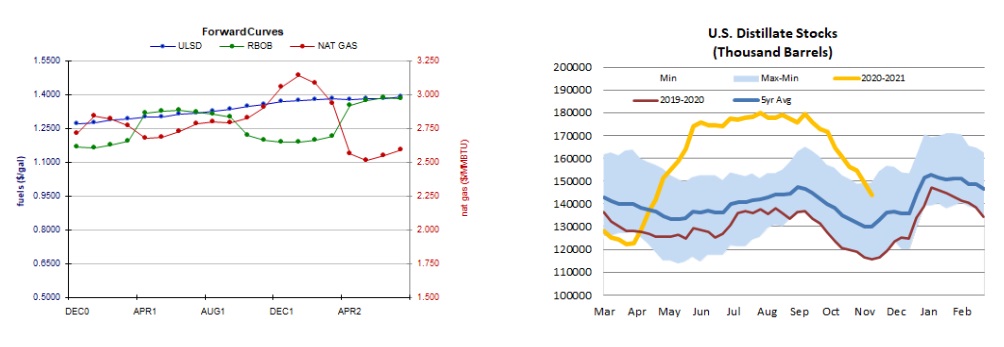

Crude futures strengthened today following news that Pfizer's coronavirus vaccine efficacy proved to be higher than previously estimated, following the conclusion of its late-stage trial. In European economic news, consumer price inflation in the Eurozone matched expectations in October, with the HICP up 0.2% as expected. European shares closed higher, with the FTSE 100 rising 0.3% and both the DAX and CAC 40 gaining 0.5%. Canadian consumer price inflation was stronger than expected, with the CPI up 0.4% in October, double the 0.2% consensus. US data were mixed. Housing starts jumped up from an upwardly-revised annualized rate of 1.459m in September to 1.530m in October, but permits were a miss as they came in at 1.545m, whereas a 1.560m pace had been predicted. As of this writing, US stock market indexes were seeing mixed trade with the S&P 500 and Dow just under the unchanged mark, whereas the Nasdaq was just above it. The US dollar index was falling for a fifth consecutive session, down 0.1%. The ULSD crack was widening following bullish US distillate stock data from the EIA today (crude oil data were neutral), and the gasoline crack was weakening following bearish gasoline inventory figures. Reuters reports that unrest is rising in Nigeria and that oil companies are tightening security. In bearish news, the Norwegian oil company Equinor says it will be increasing capacity at its Johan Sverdrup field by 30kb/d to 500kb/d by the end of the year.

NATURAL GAS | WEATHER | INVENTORIES

Natural gas futures on NYMEX strengthened slightly today, with a stronger degree day outlook and a tightening picture of next week's US market balance. The Global Forecast System now sees 281 HDDs over the next two weeks, up from 262 previously and closer to the 30-year average of 330 and also last year's 311 HDDs during the same period. Also supportive and consistent with this, Refinitiv analysts raised their total US demand forecast for next week by 1.7bcf/d to 101.3bcf/d, while raising their supply forecast by a smaller 0.5bcf/d to 98.4bcf/d, implying 2.9bcf/d withdrawals from storage. The EIA is due to provide its natural gas storage report for the week ended November 13 tomorrow, expected to show an 18bcf injection according to a Reuters poll of analysts. This would be in contrast to a 24bcf five-year average withdrawal and a 66bcf drop in storage levels during the same week last year. The 1-5 day outlook calls for above-normal temperatures across most of the country, save for some parts of northern New England and the Lower Atlantic. The 6-10 and 11-15 day outlook see mixed, mostly above-normal temperatures in consuming regions.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures settled 2.0% higher in an upside session today – inconsistent with our bearish bias. With the RSI, the MACD, moving averages, and candlesticks all bullish, and neutral slow stochastics, we are going to take neutral/bullish stance now. We continue to see nearby support at the 100-day ma ($1.1902) and then down at the 200-day ma ($1.1564), while $1.3054 and $1.3500 are expected to offer resistance. RBOB futures rose 0.8% in an upside session today with bulls taking out the 50-day ma ($1.1570) along the way. Slow stochastics, the RSI, and the MACD are neutral, while candlesticks are bullish, and we are going to take a neutral stance now, awaiting further developments. Nearby resistance is still seen at the 100-day ma ($1.2033) and then up at $1.2546, with the 200-day ma ($1.1148) and $1.0310 expected to offer support. WTI futures gapped lower overnight but strengthened intraday to settle 0.9% higher in an upside session. Slow stochastics crossed bullishly in neutral territory, and the RSI is quite neutral as well, while the MACD and candlesticks are bullish. The 9-day ma ($40.67) is now above the 100-day ma ($40.47), indicating bullish moving averages. We are also going to fall back on the sidelines here, still seeing nearby resistance at $43.78 and then at $45.27, with the 100-day ma and the 200-day ma ($36.26) seen offering support. Lastly, natural gas futures added 0.7% in an upside session today, settling in the bottom half of today’s range – somewhat consistent with our neutral bias which we maintain. We continue to see nearby support at the 50-day ma ($2.670), followed by $2.403, whereas $2.762 and then $2.898 are our nearby resistance levels.