The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

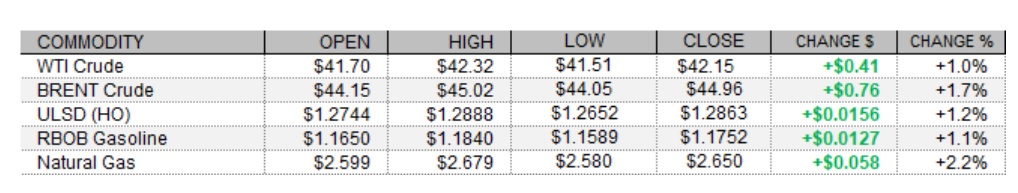

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

Petroleum futures saw modest strength today amid gains in European shares and a drop in the US oil rig count, despite mixed trade in US shares and a slightly stronger US dollar. UK retail sales growth of 1.2% in October handily beat expectations at 0.3%, and consumer confidence in the Eurozone deteriorated less than expected this month according to a flash reading (-17.6). European shares closed higher today, with the FTSE 100 up 0.3% and both the DAX and CAC 40 gaining 0.4%. In US news, Senator Schumer said that Senator McConnell has agreed to continue talks on a coronavirus aid package. Nevertheless, US stock market indexes were mixed with the Dow down 0.4% and the S&P 500 off 0.2% while the Nasdaq edged up 0.2%. The US dollar index was up 0.1%, which was unsupportive for oil prices. In supportive supply-side news, Baker Hughes reported a drop of 5 in the US oil rig count this week to 231, which represents a sharp drop of 440 from the same week last year.

NATURAL GAS | WEATHER | INVENTORIES

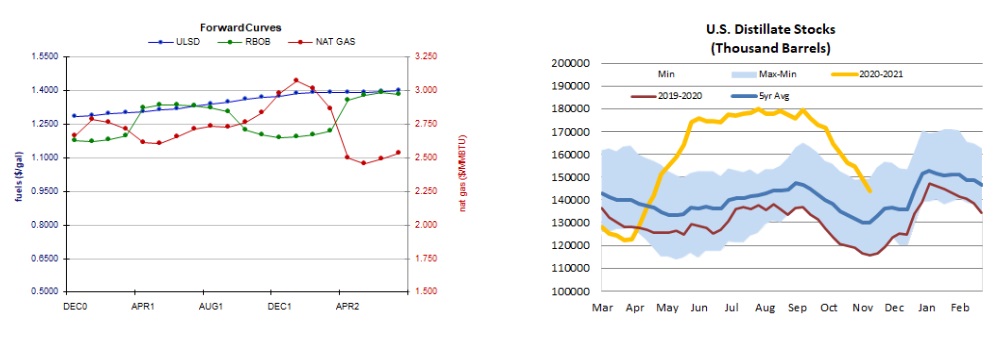

Natural gas futures saw modest strength today with a stronger two-week degree day forecast, despite a looser picture of next week's market balance and a rise in the rig count. The Global Forecast System sees 276 HDDs over the next two weeks, up from 271 prior - but well below the 341-HDD 30-year average and also last year's 311 HDDs during the same period. In unsupportive news, Refinitiv analysts cut their total US demand forecast for next week by 0.4bcf/d to 99.5bcf/d, while raising their supply forecast by 0.1bcf/d to 98.9bcf/d, implying smaller withdrawals of 0.6bcf/d. Also unsupportive, Baker Hughes reported a rise of 3 in the US natural gas rig count this week. This is, however, a drop of 52 from the same week last year. In the cash market today, Henry Hub prices fell from $2.37 to $2.19/mmBtu, Transco Zone 6 prices in New York fell from $1.73 to $1.49/mmBtu, and Algonquin citygate prices dropped down from $1.87 to $1.45/mmBtu. The temperature outlook remains unsupportive, with near to above-normal (and mostly above) temperature expected across much of the country in the latest 1-5, 6-10, and 11-15 day outlooks based on the European model.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures strengthened 1.2% today in an upside session, consistent with our upside bias. Volume was average. Slow stochastics are approaching but have not yet reached overbought territory, and so we'll stick to our bullish guns - still seeing nearby resistance at the $1.3054 high from August, followed by the $1.3500 psychological level, whereas the 100-day ma ($1.1919) and then the 200-day ma ($1.1526) are seen offering nearby support. RBOB futures added 1.1% in an upside session, with the 9-day ma ($1.1616) and the 50-day ma ($1.1600) seeming to offer some support at the lows. The MACD has risen up to the 0 line, and slow stochastics and candlesticks point higher, but the RSI is more neutral and so are the major averages. We'll stick to the sidelines for now, still looking to the 100-day ma ($1.2026) and then to $1.2546 for nearby resistance, whereas the 200-day ma ($1.1114) and then $1.0310 are our nearby support levels. WTI futures added 1.0% in an upside session, but although we have been seeing higher lows over the past six or so sessions, we haven't really been seeing higher highs - creating a wedge-shaped pattern. We'll stick to the sidelines for now, expecting things to resolve themselves in a breakout in one direction or the other in the coming sessions. Nearby resistance is expected at $43.78 and then at $45.27, whereas the 100-day ma ($40.52) and then the 200-day ma ($36.17) should offer nearby support. Lastly, NYMEX natural gas futures added 2.2% today in an inside session, with the 50-day ma ($2.683) offering resistance as expected at the highs. We remain neutral for now, but note that slow stochastics look set to cross for a buy signal in oversold territory. The RSI (42.3) cannot confirm oversold conditions, however. After the 50-day ma, we see next resistance at $2.762, whereas $2.403 and then the 200-day ma ($2.080) are our nearby support levels.