The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

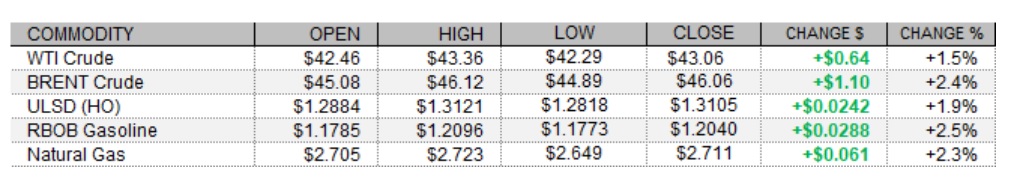

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

The complex strengthened further today amid positive news on AstraZeneca's coronavirus vaccine candidate and geopolitical tensions, although European shares closed slightly in the red following disappointing data on the Eurozone economy. The flash Markit Composite PMI for the Eurozone came in at 45.1 this month, below consensus at 46.0 and down from 49.4 last month - indicating the contraction accelerated, likely impacted by the resurgence of the pandemic and the restrictions that followed. Individual country PMIs for Germany and France beat expectations, however, as did the UK PMI. Nevertheless, the FTSE 100, CAC 40, and DAX all shed 0.1% today. The flash Markit US Composite PMI for November came in at 57.9, up from an upwardly-revised 56.3 in October and beating forecasts at 55.6. As of this writing, the Dow was up 0.7%, the S&P 500 had gained 0.3%, and the Nasdaq was up 0.2%. The US dollar index was falling this morning, but had recovered this afternoon for a 0.1% gain as of this writing. In supportive geopolitical news, Houthi forces in Yemen claimed to have launched a missile at a Saudi Aramco facility in Jeddah, and Libya's National Oil Corp. said it would temporarily stop sending sales revenues to the country's central bank, as the bank had misrepresented energy revenues - and that transfers would resume once there is a comprehensive political settlement and the bank becomes transparent over its distribution of oil revenues.

NATURAL GAS | WEATHER | INVENTORIES

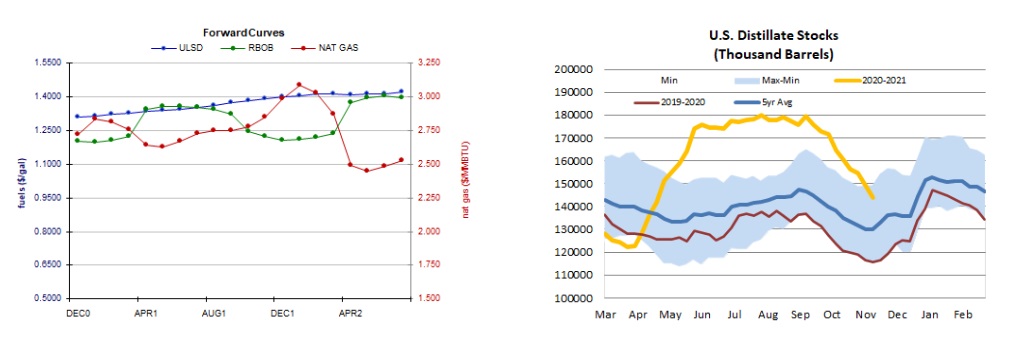

NYMEX natural gas futures strengthened today with a fairly sharp upward revision to the two-week heating degree day forecast. The Global Forecast System now sees 318 HDDs over the next two weeks, up from 276 in the prior outlook and closer to both the 357-HDD 30-year average and also to last year's 338 HDDs over the same period. Consistent with this, Refinitiv analysts raised their total US demand forecast for this week by 1.2bcf/d to 100.7bcf/d, while trimming their supply forecast by 0.1bcf/d to 98.8bcf/d, implying 1.9bcf/d withdrawals from storage. Next week, total demand is seen rising to an average of 111.8bcf/d, and with supply at 98.9bcf/d, larger withdrawals of 12.9bcf/d are the expectation. Taking a regional look at this with the latest outlooks based on the European model, above-normal temperatures are expected for the eastern two-thirds of the country over the next 5 days, and the 6-10 day period is seen bringing above-normal temperatures both near the Great Lakes and along the East Coast. In the cash market today, benchmark Henry Hub prices fell from $2.37 to $2.19/mmBtu, Transco Zone 6 prices in New York fell from $1.73 to $1.49/mmBtu, and Algonquin citygate prices went the same direction, down from $1.87 to $1.45/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

Consistent with our upside bias, ULSD futures climbed 1.9% higher in an upside session today, taking out nearby $1.3054 resistance (August high) - although volume was relatively thin, with the holidays coming up. Slow stochastics are overbought and the ADX is too weak to indicate any trend, but other indicators continue to point higher and so we'll stick with the bulls for now. We now look to today's $1.3121 high for nearby resistance, followed by the $1.3500 psychological level, whereas the 100-day ma ($1.1927) and then the 200-day ma ($1.1512) remain nearby support. RBOB futures also continued higher, gaining 2.5% today in an upside session and taking out nearby 100-day ma ($1.2020) resistance on a settlement basis. This becomes nearby support, followed by the 200-day ma ($1.1098). We'll continue to favor the upside, as the MACD has crossed bullishly up and over the 0 line and as candlesticks, the RSI, and slow stochastics all point higher. Next resistance expected at $1.2546, followed by $1.3000. WTI futures continued higher as well today, rising 1.5% in an upside session after a gap higher over the weekend. Candlesticks, the MACD, slow stochastics, and the RSI all point higher, and the moving averages are moving from neutral to bullish as well. We continue to see $43.79 and then $45.27 offering resistance, while the 100-day ma ($40.54) and then the 200-day ma ($36.14) should offer support. Finally, NYMEX natural gas futures added 2.3% in an upside session today, gapping up and over the 50-day ma ($2.691) over the weekend - this had been nearby resistance and becomes nearby support (followed by $2.403). Next resistance seen at $2.762 and then $2.898. Slow stochastics have crossed for a buy signal and are rising bullishly, while the RSI is more neutral. Major averages point higher, but the MACD is falling down towards the 0 line bearishly. We'll remain sidelined for a little longer.