The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

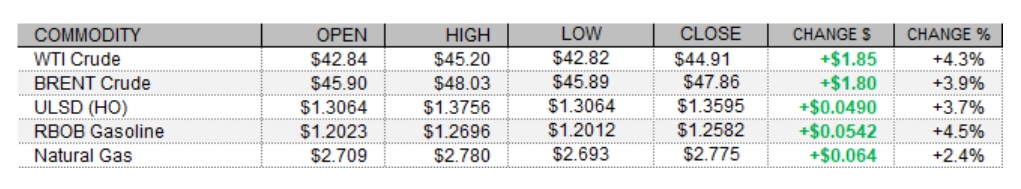

Petroleum futures continued higher today, with gains of over 3.5%, amid news that the Trump administration has given Biden access to resources that will enable him to take over the office in January, gains in equities, and weakness in the US dollar. Reuters reported that Saudi Aramco said that its domestic fuel supplies had not been affected by an attack by Yemen’s Houthi group on a distribution plant in Jeddah and that operations resumed three hours after the attack. In US economic news, the S&P CoreLogic Case-Shiller Home Price Index rose 1.3% in September, above the Econoday consensus at 0.5%. On the other hand, the Conference Board's Consumer Confidence Index fell from an upwardly-revised 101.4 to 96.1 this month, missing expectations at 98.0. European shares closed higher today with the CAC 40 up 1.2%, the DAX adding 1.3%, and the FTSE 100 gaining 1.6%. US stock market indexes were seeing gains of between 1.2% (Nasdaq) and 1.7% (Dow) as of this writing. Also supportive for crude oil prices, the US dollar index was down 0.2%.

NATURAL GAS | WEATHER | INVENTORIES

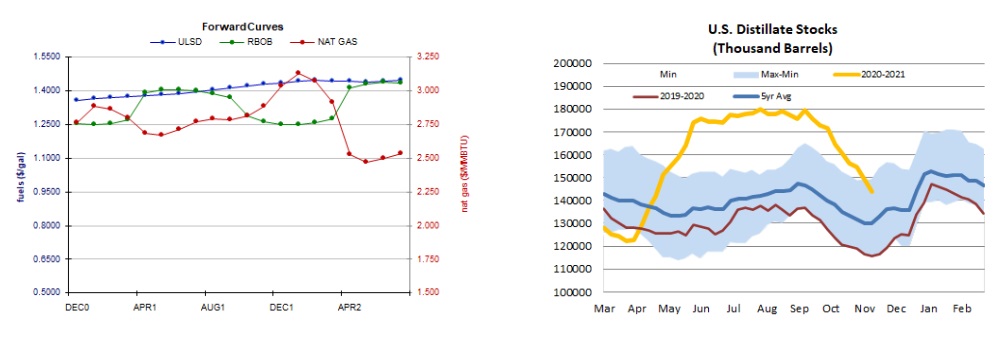

Natural gas futures strengthened today amid a tighter market balance expectation for next week and a stronger two-week heating degree day forecast. Refinitiv analysts now see total US demand of 114.4bcf/d outpacing US supply at 99.3bcf/d next week, implying larger withdrawals of 15.1bcf/d (compared to yesterday’s forecast at 12.9bcf/d). The Global Forecast System raised its heating degree day forecast for the next two weeks from 318 to 339, which is closer to the 30-year average of 363 and just below last year's 338 HDDs over the same period. The latest 1-5 day forecast (EC) sees above-normal temperatures across the eastern half of the country. The 6-10 and 11-15 day outlooks are more supportive with mixed temperatures expected in both the Midwest and the Northeast. In the cash market today, prices at the Henry Hub benchmark rose from $2.21 at $2.23/mmBtu, Transco Zone 6 prices in New York jumped from $1.70 to $2.20/mmBtu and Algonquin citygate prices jumped from $1.88 to $2.83/mmBtu. According to a Reuters poll of analysts, estimates for the weekly EIA petroleum inventory report for the week ended November 20 call for a 0.1mb rise in US crude stocks and a 0.9 percentage point predicted increase in the nation’s refinery utilization rate. Distillate stocks are expected to fall by 1.6mb, while gasoline stockpiles are expected to increase by 0.6mb. API petroleum inventories for the same week are due this afternoon at 4:30. The EIA is also due to provide its natural gas storage report for the week ended November 20 tomorrow, expected to show a 30bcf withdrawal according to a Reuters poll of analysts. This would be below a 37bcf five-year average withdrawal and a 47bcf drop in storage levels during the same week last year.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

Consistent with our directional bias, ULSD futures rallied 3.7% today in an upside session, taking out yesterday's high (R1) early on and continuing on to settle above the $1.35 mark (R2). Slow stochastics and the RSI are now both overbought, but we will refrain from calling a top as candlesticks, the MACD, and major averages all point higher, and as the ADX is nearly strong enough to say something for the first time in quite a while. A retracement tomorrow after a jump of this magnitude would not be a huge surprise, however. Next resistance expected at $1.4000, followed by $1.4600 (61.8% 2016-2018 rally), whereas $1.3500 and then $1.3068 become nearby support. We were also bullish for RBOB, and futures shot up 4.5% in an upside session, taking out $1.2546 resistance but retreating from the highs and not quite reaching next resistance at $1.3000 (after which lies $1.3932). Nearby support at $1.2546 and then at the 100-day ma ($1.2021). We remain sided with the bulls, but with the caveat about a retracement tomorrow, and this is also our view on WTI, which jumped 4.3% higher today in a manner consistent with our views. We saw nearby $43.79 resistance taken out, but not $45.27 - and this becomes nearby resistance, followed by $50.54. Nearby support at $43.79 and then at the 100-day ma ($40.59). Slow stochastics are overcooked but the RSI (67.8) can't quite confirm. Lastly, NYMEX NG futures added 2.4% in an upside session, taking out $2.762 resistance. Slow stochastics, candlesticks, and the RSI point higher, as do the major averages. Still, major averages are weakening and the MACD is falling down to the 0 line. We'll stick to the sidelines awaiting strong evidence for the bullish case. Nearby resistance becomes $2.898, followed by $3.182, whereas $2.762 and then $2.403 are our nearby support levels.