The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

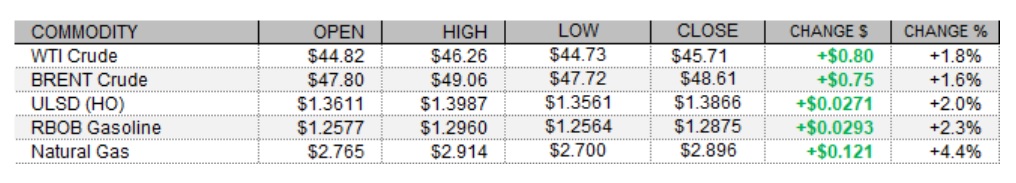

Petroleum futures extended their rally to a fourth consecutive session ahead of the holiday tomorrow, as the US dollar extended its sell-off and with geopolitical tensions in the Middle East, despite mixed trade in equities. Reuters reports that, according to Ambrey maritime security company, a Greek-operated oil tanker was hit by a mine at a Saudi Arabian terminal, damaging its hull. The incident follows a missile attack on an Aramco facility in Jeddah this week. Also supportive, the US dollar index was trading 0.3% weaker as of this writing, at its weakest levels since late August. European shares settled mixed, with the FTSE 100 losing 0.6% but the DAX nearly unchanged and the CAC 40 adding 0.2%. US shares were also mixed this afternoon, with the Nasdaq up 0.4% but the S&P 500 down 0.2% and the Dow having lost 0.5%. With the holiday tomorrow, it was a heavy day on the economic calendar. US durable goods orders saw stronger than expected growth of 1.3% in October, and the advance estimate of the October US international trade in goods deficit was narrower than expected at $80.8bn. Also encouraging, new home sales in October hit a stronger than expected annualized pace of 999,000. In the neutral column was the second estimate of third quarter GDP, which was left unrevised at an annualized 33.1%. There were some misses, as weekly initial jobless claims were higher than predicted at 778,000, consumer sentiment (U. Mich.) was softer than expected this month at 76.9, and as personal incomes shrank by 0.7% unexpectedly in October. In unsupportive supply-side news, Baker Hughes reported a rise of 10 in the US oil rig count this week, to 241.

NATURAL GAS | WEATHER | INVENTORIES

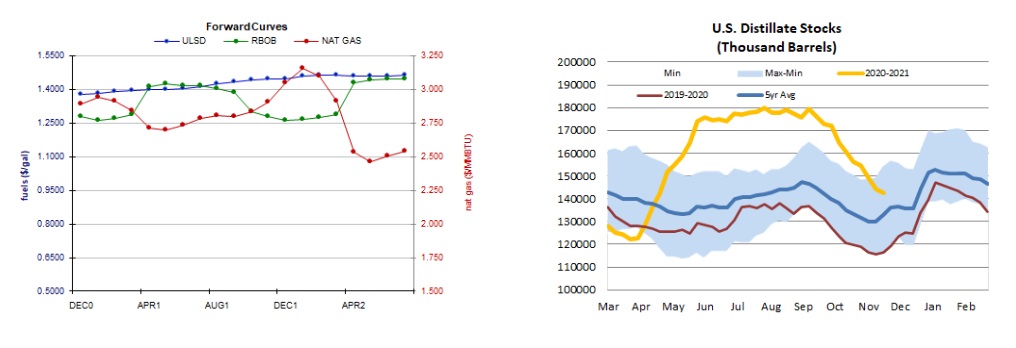

Natural gas futures strengthened today amid another upward revision to the two-week heating degree day forecast, despite a looser market balance expectation for next week. The Global Forecast System raised its two-week heating degree day forecast by 8 to 347, which is closer to the 30-year average of 368 and tops the 338 HDDs seen last year during this period. The latest outlooks based on the European model indicate this cold will be coming in the 6-10 and 11-15 day periods, but not so much to the northernmost latitudes, as the 6-10 day period sees mixed temperatures in the Midwest and above-normal temperatures in the Northeast. The 11-15 day forecast is more supportive, with mixed temperatures in the Midwest but mostly below-normal temperatures on the East Coast. Above-normal temperatures are expected in both consuming regions over the next 5 days. Refinitiv analysts trimmed their total US demand forecast for next week by 1.5bcf/d to 112.9bcf/d, while keeping their supply forecast steady at 99.3bcf/d, implying smaller withdrawals of 13.6bcf/d. In unsupportive supply-side news, Baker Hughes reported a rise of 1 in the US natural gas rig count this week, to 77. Cash natural gas prices were mixed today, as benchmark Henry Hub prices strengthened from $2.23 to $2.47/mmBtu, but Transco Zone 6 prices at the New York citygate fell from $2.02 to $1.72/mmBtu, and as Algonquin citygate prices tumbled down from $2.83 to $1.81/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures added 2.0% in an upside session today – consistent with our bullish bias which we maintain. Slow stochastics have crossed bearishly in overbought territory and the RSI confirms overbought conditions, whereas candlesticks, moving averages, the MACD, and the ADX all point higher. We continue to see nearby support at $1.3500 and then down at $1.3068, with $1.4000 and $1.4600 expected to offer resistance. Also consistent with our directional bias, RBOB futures gained 2.3% in an upside session. Stochastics are overbought but the RSI does not confirm overbought conditions (67.9), and candlesticks and the MACD are bullish. We continue to favor upside chances, still seeing nearby resistance at $1.3000 and then up at $1.3932, while $1.2546 and the 100-day ma ($1.2023) are seen as nearby support levels. WTI futures settled 1.8% higher in an upside session – also consistent with our upside bias which we continue to maintain. Bulls took out the $45.27 resistance level, which now becomes nearby support, followed by $43.79, while $50.54 and $52.17 are our nearby resistance levels. Lastly, natural gas futures rose 4.4% in an upside session. Slow stochastics, the RSI, candlesticks, and moving averages all point higher, while the MACD is neutral but looks set to cross the zero line and become bearish. We settled just below the $2.898 resistance level, and we continue to look there and then up at $3.182 for resistance, whereas $2.762 and $2.403 are our nearby support levels. We are going to side with the bulls now.