The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

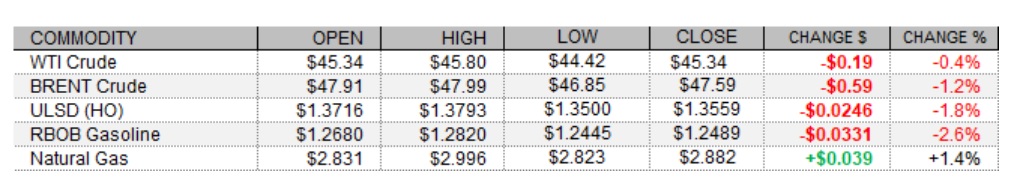

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

The complex lost ground today, as did equities, following disappointing US economic data releases (despite largely supportive data from abroad). European shares lost ground today, with the FTSE 100 falling 1.6% and the CAC 40 losing 1.4%, The DAX held its ground a bit better, but still slipped 0.3% lower. As for the US shares, as of this writing the Dow had lost 1.1%, the S&P 500 was trading 0.7% weaker, and the Nasdaq was off 0.4%. The US dollar index earlier hit its weakest levels since April of 2018, but had recovered by this afternoon, and was up 0.1% - which is unsupportive for oil prices. The NAR Pending Home Sales Index for October, expected to rise 2.0%, instead saw a 1.1% surprise drop. Also disappointing, the Chicago PMI for November fell to 58.2, below consensus at 59.2. Market participants were likely closely watching the OPEC meeting today, with a wider OPEC+ to follow. Reuters reports that the Algerian Energy Ministry indicates there is consensus among members of OPEC for an extension of the current level of output cuts for three months (through the end of March), and that they would be trying to convince their non-OPEC allies to support the move.

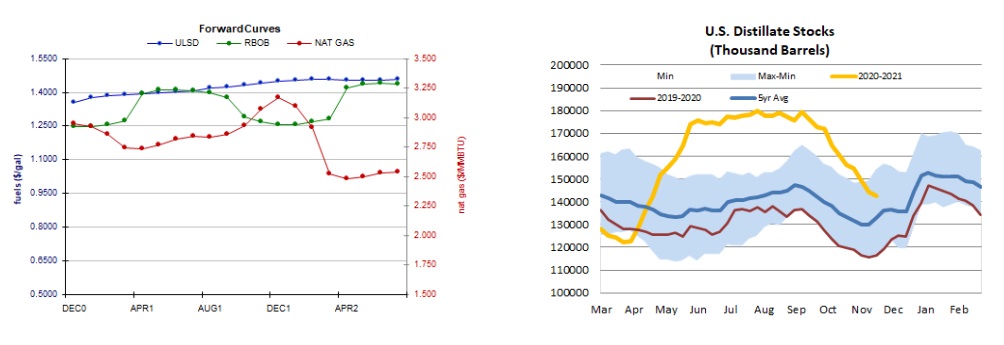

NATURAL GAS | WEATHER | INVENTORIES

NYMEX natural gas futures strengthened today with a stronger two-week heating degree day forecast and a tighter market balance expectation for this week. The Global Forecast System now sees 388 HDDs over the next two weeks, up from 365 previously. This is closer to the 392-HDD 30-year average and tops last year's 362 HDDs during the same period. Also supportive, Refinitiv analysts raised their total US demand forecast for this week by 0.3bcf/d to 113.2bcf/d, while trimming their supply forecast by 0.3bcf/d to 99.0bcf/d, implying 14.2bcf/d withdrawals from storage. Next week, demand is seen rising by 5.9bcf/d to 119.1bcf/d, while supply rises by just 0.2bcf/d to 99.2bcf/d, implying larger withdrawals of 19.9bcf/d. Much of the below-normal temperatures over the next couple of weeks, however, are expected to occur in the southern half of the country. The latest ECWMF model calls for mixed temperatures in the Midwest and above-normal temperatures in the Northeast over the next 5 days. The 6-10 day outlook sees below-normal temperatures across much of the East Coast, but above-normal temperatures west of the Great Lakes. The 11-15 forecast is less supportive, with above-normal temperatures in the Midwest and mixed temperatures on the East Coast.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures slipped 1.8% lower today in a downside session (lower high and a lower low), but did not take out nearby $1.3500 support on a settlement basis. We are now sidelined, given a mixed technical picture with overbought RSI and slow stochastics along with bearish candlesticks, whereas the MACD, major averages, and the ADX all point higher. We will be looking out for bearish confirmation in tomorrow's session. After $1.3500, we see support at $1.3068, whereas the recent $1.3987 high and then $1.4600 are our nearby resistance levels. RBOB futures are also showing signs of happing topped out, falling 2.6% in a downside session and taking out $1.2546 support in the process. Overbought slow stochastics have crossed for a sell signal, but the RSI (61.8) can't confirm overbought conditions. Meanwhile, major averages are strengthening with the 9-day ma having recently crossed up and over the 100-day ma ($1.2023). We remain neutral, pending stronger evidence from the bears, with support now at the aforementioned 100-day ma and then down at the 200-day ma ($1.1040), whereas $1.2546 and then the recent $1.2960 are seen offering resistance. WTI futures edged down 0.4% in a downside session, and slow stochastics have crossed for a sell signal in overbought territory here as well. The RSI is falling bearishly (68.4). Meanwhile, major averages are neutral/bearish and the MACD points higher. Again, we are neutral pending bearish confirmation, seeing next support at $45.27 and then $43.79, whereas $50.54 and $52.17 are our nearby resistance levels. NYMEX natural gas futures gapped down over the weekend but then gained 1.4% in an outside session today (higher high, but also that lower low). Slow stochastics have crossed for a sell signal in overbought territory, but here the RSI is quite neutral at 54.8. We remain sided with the bulls, still looking to $3.182 and then $3.396 (recent high) for resistance, with $2.898 and then $2.762 as our nearby support levels.