The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

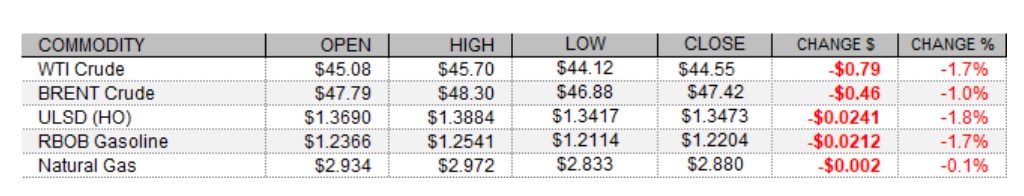

Petroleum futures fell for a third consecutive session today amid news that OPEC+ has delayed talks over next year’s output policy due to disagreement among some key members, despite gains in equities and weakness in the US dollar index. Reuters reported that OPEC+ has postponed its meeting to Thursday due to some key members still disagreeing on how much oil they should produce next year, according to three sources. Sources said that Russia suggested the possibility for OPEC+ to start increasing output by 0.5mb/d each month from January, while Saudi Arabia would like to consider extending existing cuts into the first three months of 2021. In more unsupportive news, Norway’s oil output curbs, which have been in place since June, are set to end on December 31, according to the country's Ministry of Petroleum and Energy. In economic news, data on the Canadian economy missed expectations. GDP rose 8.9% in Q3, below the 10.3% predicted increase, and GDP growth of 0.8% in September missed the 0.9% forecast. Data for the US manufacturing sector for last month were neutral to unsupportive, as the Markit index rose from 53.4 to 56.7, matching expectations, while the more established ISM index fell from 59.3, past the 57.7 consensus, to 57.5. On the other hand, US construction spending for October rose 1.3%, beating expectations at 0.8%. European stock markets closed higher today with the DAX up 0.7%, the CAC 40 adding 1.1%, and the FTSE 100 gaining 1.9%. As of this writing, US stock market indexes were seeing gains of between 0.9% (Dow) and 1.6% (Nasdaq). Also supportive for crude oil prices, the US dollar index was down 0.6%.

NATURAL GAS | WEATHER | INVENTORIES

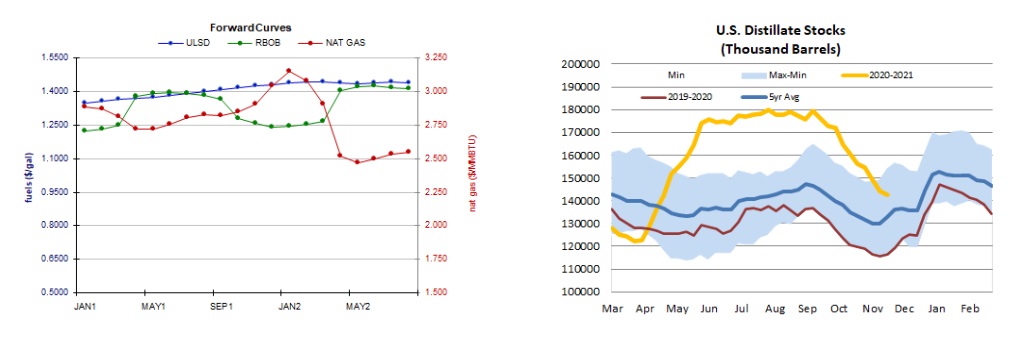

Natural gas futures turned back south today amid a looser market balance expectation for next week. Refinitiv analysts now see total US demand of 115.6bcf/d outpacing US supply at 99.9bcf/d next week, implying smaller withdrawals of 15.7bcf/d (compared to yesterday’s forecast at 19.9bcf/d). The Global Forecast System cut its heating degree day forecast for the next two weeks by 1 to 387, which is below the 30-year average of 396, but above last year's 362 HDDs over the same period. The latest 1-5 day forecast (EC) sees above-normal temperatures in the Northeast but mixed temperatures in the Midwest. The 6-10 day outlook calls for mostly above-normal temperatures in the Midwest, while near normal temperatures are expected in the Northeast. In the cash market today, prices at the Henry Hub benchmark rose from $2.35 at $2.89/mmBtu, Transco Zone 6 prices in New York jumped from $1.35 to $2.64/mmBtu and Algonquin citygate prices jumped from $1.31 to $2.28/mmBtu. According to a Reuters poll of analysts, estimates for the weekly EIA petroleum inventory report for the week ended November 27 call for a 2.4mb draw from US crude stocks and a 0.9 percentage point predicted increase in the nation’s refinery utilization rate. Distillate stocks are expected to fall by 0.2mb, while gasoline stockpiles are expected to increase by 2.4mb. API petroleum inventories for the same week are due this afternoon at 4:30.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures fell further today, but in an outside session as we saw a higher high to go along with today's lower low. While that gives us some pause, with continued downside movement and bearish slow stochastics, RSI, and candlesticks, we'll adopt a neutral/bearish stance, seeing next support at $1.3068 and then at the 100-day ma ($1.1992), whereas the $1.3500 mark we saw taken out today becomes nearby resistance, followed by the $1.3987 high. We also side with RBOB bears, and do so with more conviction that with HO, as we gapped lower overnight and fell 1.7% in a downside session. Stochastics, the RSI, and candlesticks all point lower, and here the major averages are much closer to neutral, with only the 9-day ma trading above the longer averages. We continue to look to the 100-day ma ($1.2016) and then to the 200-day ma ($1.1019) for support, whereas $1.2546 and then $1.2960 are our nearby resistance levels. WTI fell 1.7% today in a downside session, and we side with the bears here as well. Indicators are similar to those in RBOB. With $45.27 support taken out today, we look next to $43.79 and then $40.00 as next support. Natural gas futures, edged down 0.1% today in an inside session, with the 18-day ma ($2.832) serving as a floor in today's session. We settled back below $2.898, which becomes nearby resistance (followed by $3.182), whereas $2.762 and then $2.403 are next support. Slow stochastics have crossed for a sell signal and are falling bearishly, whereas the RSI and candlesticks are neutral. Major averages are neutral/bearish, and the MACD is neutral. We'll take a neutral stance here.