The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

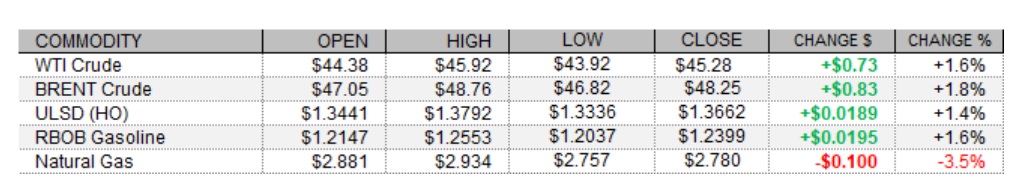

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

Petroleum futures strengthened today despite an unsupportive weekly EIA inventory report, perhaps with help from a dip in the US dollar index (although it saw see-saw trade today). Equities were mixed, but the UK's FTSE 100 strengthened following the approval of the Pfizer/BioNTech vaccine. The British regulator MHRA gave the green light for inoculations to begin as soon as next week. The FTSE 100 climbed 1.2% higher today. Meanwhile, France's CAC 40 settled near unchanged, and the DAX in Germany fell 0.5%. The dip in the DAX came despite stronger than expected German retail sales data for October. Sales grew 2.6%, beating the 1.0% forecast, and September sales were revised up from a 2.2% drop to a 1.9% decline. The unemployment rate in the Eurozone came in at 8.4% for October, matching expectations, but the September rate was revised up 0.2pp to 8.5%. Producer price inflation in October was stronger than predicted, with the PPI up 0.4% m/m (0.1% consensus). In US news, ADP showed a 307,000 increase in private payrolls for November - well below the 420,000 forecast. Some consolation could be found in that October payrolls were revised up by 39,000 to a 404,000 gain. As of this writing, the major US stock market indexes were mixed with the Dow and Nasdaq both off 0.1%, while the S&P 500 was up marginally. The US dollar index was down 0.2%.

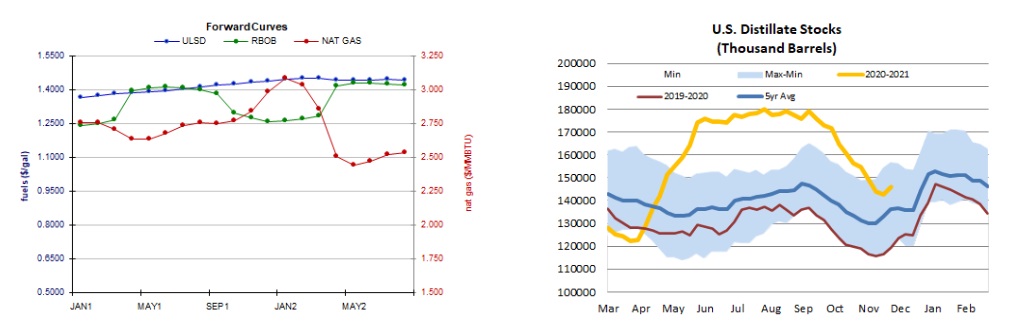

NATURAL GAS | WEATHER | INVENTORIES

Natural gas futures lost ground today despite a stronger degree day forecast and a tightening picture of next week's market balance. The Global Forecast System revised up its two-week heating degree day forecast by 3 to 390, which is close to the 30-year average of 400 and well above last year's 362 HDDs over the same period. Also supportive, Refinitiv analysts kept their total US supply forecast for next week steady at 99.9bcf/d, while raising their demand forecast by 1.2bcf/d to 116.8bcf/d - implying 16.9bcf/d withdrawals from storage. The latest 1-5 day outlook based on the European model calls for above-normal temperatures in the Northeast and near the Great Lakes. The 6-10 day outlook is slightly more supportive for the East Coast, but not for the western two-thirds of the country. The 11-15 day forecast does see near to below-normal temperatures across the country, however. The EIA is due to release its weekly natural gas storage report tomorrow, and analysts polled by Reuters see an 18bcf withdrawal being reported. This would be smaller than both the 37bcf five-year average and last year's 47bcf drop for the same week. In the cash market today, Henry Hub prices held steady at $2.89/mmBtu, and Transco Zone 6 prices at the New York citygate shed just one cent to reach $2.63/mmBtu, but Algonquin citygate prices were more active, rising from $2.28 to $2.44/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures rose 1.4% in a low-volume downside session (lower high, lower low) – somewhat consistent with our neutral/bearish bias. Slow stochastics continue to point lower, while the RSI and candlesticks are neutral, and the MACD is bullish. We are going to stick to our neutral/bearish stance for now, seeing nearby support at $1.3500 (taken out today) and then down at $1.3068, while $1.3987 (recent high) and $1.4600 are expected to offer resistance. RBOB futures settled 1.6% higher in an outside session (higher high, lower low) – inconsistent with our bearish bias. Slow stochastics are still bearish, while the RSI and candlesticks are more neutral, along with moving averages, whereas the MACD points higher. We are going to remain bearish for now, still seeing nearby support at the 100-day ma ($1.2012) and then down at the 200-day ma ($1.0998), with $1.2546 and then $1.2960 seen as nearby resistance levels. WTI gapped lower but rose intraday to settle 1.6% higher in an outside session. Technical indicators are similar to those in products, so we are going to remain bearish for now. We settled just above the $45.27 resistance level and now we look at $50.54 and then up at $52.17 for resistance, while $43.79 and $40.00 are our nearby support levels. NYMEX natural gas futures dropped 3.5% in a downside session, with bears taking out the 18-day ma ($2.823) and the 50-day ma ($2.784). Slow stochastics, the RSI, candlesticks, and the MACD are all bearish, so we are going side with the bears. We continue to see nearby support at $2.762, followed by $2.403, whereas $2.898 and then $3.182 are expected to offer resistance.