The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

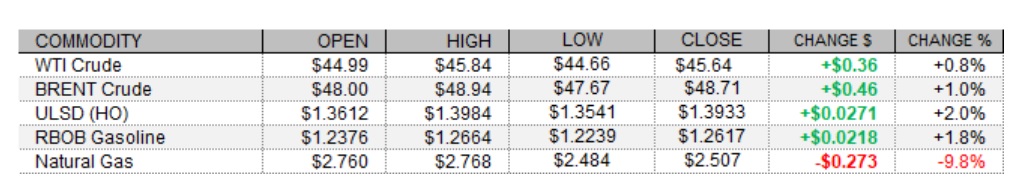

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

Petroleum futures rose for a second consecutive session today amid news that OPEC+ has reached an agreement on output policy, gains in US equities, and weakness in the US dollar. Reuters reported that OPEC and Russia have agreed to a 0.5mb/d increase from January, instead of 2mb/d as previously planned, according to four OPEC+ sources. Sources said that OPEC+ will meet every month to decide on output policies beyond January and that monthly increases are unlikely to exceed 0.5mb/d. European shares closed mixed but mostly lower today, despite largely supportive economic data, with the FTSE 100 up 0.4%, while the CAC 40 fell 0.2% and the DAX lost 0.5%. In economic news, the CIPS/Markit Composite PMI for the UK came in at 49.0 last month, above forecasts at 47.4 and the final Markit Eurozone Composite PMI also beat expectations by coming in at 45.3 (vs. 45.1). The index for France came in at 40.6, above expectations at 39.9, while the index for Germany came in at 51.7, just below the Econoday consensus at 52.0. In US economic news, weekly initial jobless claims fell from an upwardly-revised 787,000, past the Econoday consensus at 780,000, to 712,000. On the other hand, the ISM Services Index came in at 55.9 in November, just below consensus at 56.0 and down from 56.6 in October. As of this writing, US stock market indexes were seeing gains of between 0.1% (S&P 500) and 0.5% (Dow). Also supportive for crude oil prices, the US dollar index was down 0.4%.

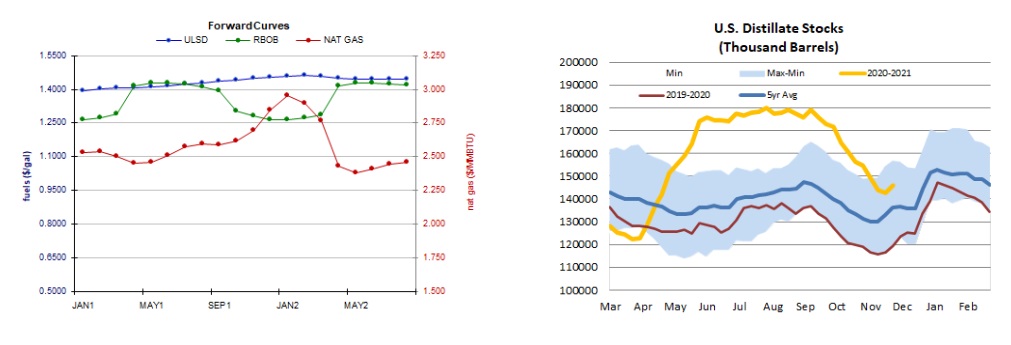

NATURAL GAS | WEATHER | INVENTORIES

Natural gas futures tumbled today amid a weaker two-week heating degree day forecast and a bearish weekly storage report from the Energy Information Administration (EIA), despite a tighter market balance expectation for next week. Refinitiv analysts now see total US demand of 117.3bcf/d outpacing US supply at 99.7bcf/d next week, implying larger withdrawals of 17.6bcf/d (compared to yesterday’s forecast at 16.9bcf/d). The EIA reported a 1bcf withdrawal from underground natural gas storage for the week ended November 27, well below forecasts at 12bcf. Total storage levels fell to 3.939tcf, which is 9.5% higher than last year and 7.9% above the five-year average for the reporting week. The Global Forecast System cut its heating degree day forecast for the next two weeks by 10 to 380, which is well below the 30-year average of 404, but above last year's 362 HDDs over the same period. The latest 1-5 day outlook (EC) sees mixed but mostly above-normal temperatures in both the Midwest and the Northeast. The 6-10 day forecast is more supportive for the Northeast as below-normal temperatures are expected in the region, whereas above-normal temperatures are seen across the western two-thirds of the country. In the cash market today, prices at the Henry Hub benchmark fell from $2.89 to $2.75/mmBtu, Transco Zone 6 prices in New York dropped from $2.63 to $2.45/mmBtu, and Algonquin citygate prices fell from $2.44 to $2.33/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures rose 2.0% in an upside session today – inconsistent with our neutral/bearish bias. Slow stochastics are neutral, while the RSI is overbought (70.5), and candlesticks and the MACD point higher, so we are going to fall back on the sidelines, awaiting further developments. We continue to see nearby support at the $1.3500 and then down at $1.3068, whereas $1.3987 and $1.4600 remain our nearby resistance levels. RBOB futures settled 1.8% higher in an upside session – not consistent with our bearish stance. Bulls took out $1.2546 resistance level, which now becomes our nearby support level, followed by the 100-day ma ($1.2014), while $1.2960 and $1.3500 are expected to offer resistance. Slow stochastics are still bearish, while the RSI, the MACD, and candlesticks are bullish. We are going to take a neutral stance now. Also inconsistent with our directional bias, WTI added 0.8%, but did so in an inside session (lower high, higher low). Stochastics, the RSI, moving averages, and candlesticks are all neutral, while the MACD is bullish, so we are going to move onto the sidelines. We continue to see nearby resistance at $50.54 and then up at $52.17, with $43.79 and $40.00 seen as nearby support levels. We sided with natural gas bears yesterday and were rewarded today with a 9.8% drop in a downside session. Bears took out the $2.762 support level, which now becomes nearby resistance, along with $2.898, while $2.403 and the 200-day ma ($2.117) are expected to offer support. We remain bearish, noting that a retracement could be possible in the next session following a drop of this magnitude.