The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

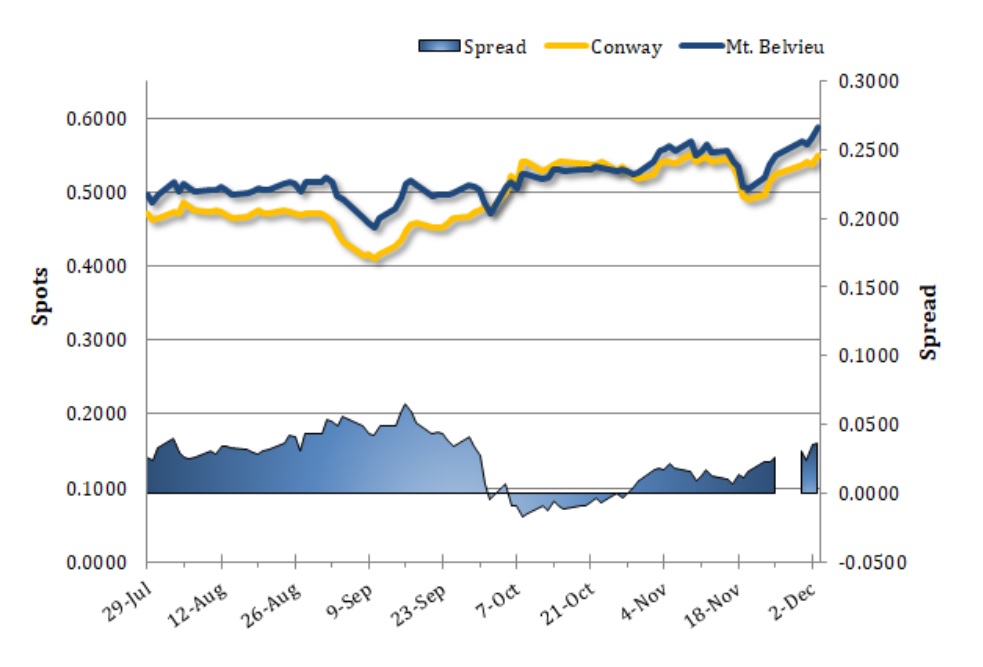

Crude futures prices strengthened yesterday amid news that OPEC+ would be raising output by up to 0.5mb/d next month, rather than the 2.0mb/d previously scheduled - although no agreement was reached for future months with this compromise. Also supportive was weakness in the US dollar and strength in US equities, although European shares fell. Brent crude rose 1.0% and WTI gained 0.8%. Mt. Belvieu TET propane prices jumped 2.5% (1.44 cents) higher to 58.69c/g and Conway prices rose by 2.3% (1.25 cents) to 55.00c/g. Meanwhile, NYMEX natural gas futures tumbled almost 10% lower amid a bearish weekly EIA storage report.

Crude futures were seeing modest gains this morning, amid strength in US stock market indexes - despite a miss in the headline US payrolls figures for November - and strength in European shares following largely encouraging economic data releases from Germany, Italy, and the UK. As of this writing, Brent futures were up 0.7% and WTI futures had gained 0.9%. Propane prices were extending their rally, with Mt. Belvieu TET up 1.5% (88 points) at 59.56c/g (non-TET at 59.75c/g) and Conway spots up 2.3% (1.25 cents) at 56.25c/g. Natural gas futures were back in the black after yesterday's drop, up 2.4%. In the news, OPIS reports that US LPG exports to Europe dropped 75% month-to-month in November amid the resurgence of the coronavirus.