The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

Crude futures added further modest gains today amid strength in US and European shares following encouraging European data (despite a less stellar US labor market report for November) and further weakness in the US dollar index, despite another weekly rise in the US oil rig count. Growth in German manufacturers' orders of 2.9% in the month of October was stronger than expected, Italian retail sales growth of 0.6% the same month also beat forecasts, and so did the November UK Construction PMI of 54.7. The UK's FTSE 100 gained 0.9% today, the DAX in Germany rose 0.4%, and the French CAC 40 gained 0.6%. US stock market indexes were also strengthening today, with the Nasdaq up 0.6% and both the S&P 500 and Dow trading 0.7% higher as of this writing. Also supportive for crude futures prices, the US dollar index was off 0.1%, having hit fresh multi-year lows earlier in the session. Supply-side news was unsupportive, however, as oil services firm Baker Hughes reported a rise of 5 in the US oil rig count this week to 246. This is the 11th weekly increase in the last 12 weeks. The count is still, however 417 lower than during the same week last year.

NATURAL GAS | WEATHER | INVENTORIES

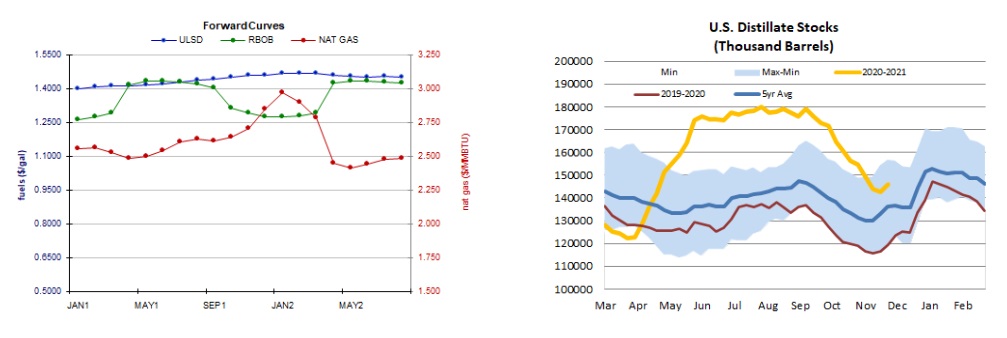

After yesterday's tumble, NYMEX natural gas futures recovered some with a tighter market outlook for next week and a dip in the rig count, despite a weaker two-week heating degree day forecast. The Global Forecast System forecasts 369 heating degree days over the next two weeks, down from 380 previously, further below the 408-HDD 30-year average and closer to last year's 362 HDDs. For just next week, however, Refinitiv analysts raised their total US demand forecast by 0.7bcf/d to 118.0bcf/d, while trimming their supply forecast by 0.3bcf/d to 99.4bcf/d, implying larger withdrawals from storage of 18.6bcf/d. Also supportive, Baker Hughes reported a drop of 2 in the US natural gas rig count this week, bringing it down to 75. The latest outlooks based on the European model call for above-normal temperatures in the Midwest over the next 10 days. The outlook for the East Coast is more supportive, with mixed but mostly slightly below-normal temperatures being the expectation. Cash market prices weakened today, with benchmark Henry Hub prices down from $2.75 to $2.46/mmBtu, Transco Zone 6 prices in New York dropping from $2.45 to $1.87/mmBtu, and with Algonquin citygate prices weakening from $2.33 to $2.17/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

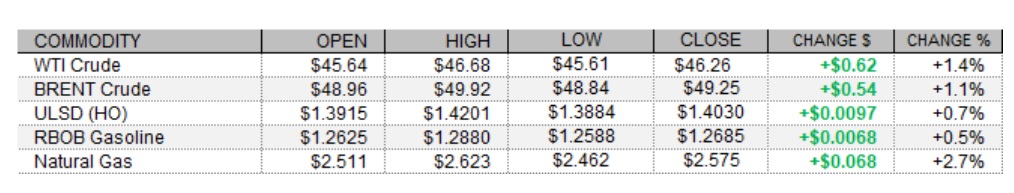

ULSD futures hit fresh highs not seen since March today, but we retreated later on to settle up just 0.7% in today's candlestick, printing a shooting star candlestick - a bearish reversal pattern requiring confirmation. As such, and helped in our decision by an overbought RSI, we'll stick to our neutral stance for now, awaiting further developments. Today's $1.4201 high becomes nearby resistance, followed by $1.4600, whereas $1.3500 and then $1.3068 are our nearby support levels. Similarly, RBOB futures edged up just 0.5% today in an upside session, printing a shooting star - and here we did not match the highs from late last month. We'll stick to the sidelines, still expecting support at $1.2546 and then at the 100-day ma ($1.2014), whereas $1.2960 and then $1.3500 are our nearby resistance levels. WTI bulls made a slightly stronger showing, posting a 1.4% gain in today's upside session and hitting intraday highs not seen since March. The MACD and major averages point higher along with candlesticks, but slow stochastics are more neutral and the RSI is close to overbought (67.9). We'll refrain from siding with the bulls just yet, seeing $50.54 and then $52.17 resistance, with $43.79 and $40.00 support. We noted yesterday that we could see a retracement following yesterday's sharp NG losses, and it appears we saw that today with a 2.7% uptick in a downside session. We spent some time below, but settled above the 100-day ma ($2.487). We remain bearish, seeing support at the $2.403 and then down at the 200-day ma ($2.120), whereas $2.762 and then $2.898 should offer resistance.