The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

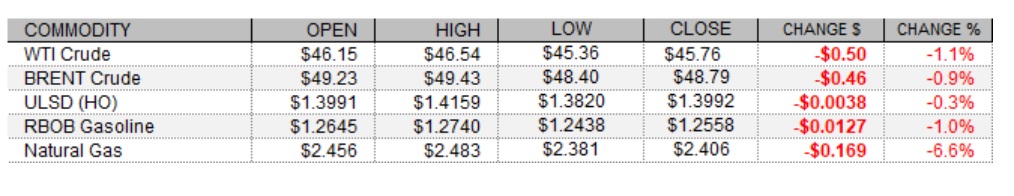

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

WTI crude and refined products futures looked set to end their three-session rally today, with small losses for most of the session, but futures recovered to near the unchanged mark in final hours - only to fall back and settle in the red. An uptick in the US dollar index off of multi-year lows was unsupportive, as was weakness in European shares. Despite stronger than expected German industrial production growth of 3.2% in October and stronger than expected home price appreciation in the UK in November (1.2%), the DAX shed 0.2% and the CAC 40 fell 0.6%. While the FTSE 100 edged up 0.1%, the Stoxx 600 dropped 0.3% lower. As of this writing, US stock market indexes were mixed but mostly lower. The tech-heavy Nasdaq was up 0.3%, but the S&P 500 was down 0.3% and the Dow had lost 0.6%. US-China tensions may have been weighing on valuations, with Reuters reporting that the US was preparing to sanction 12 or more Chinese officials for involvement in the disqualification of elected opposition leaders in Hong Kong. Also unsupportive, the governor of California ordered region-by-region lockdowns with ICU beds filling up due to the resurgence of the coronavirus. Also in the news today, Reuters reports that multiple sources say the next OPEC+ policy-setting meeting could take place on January 4.

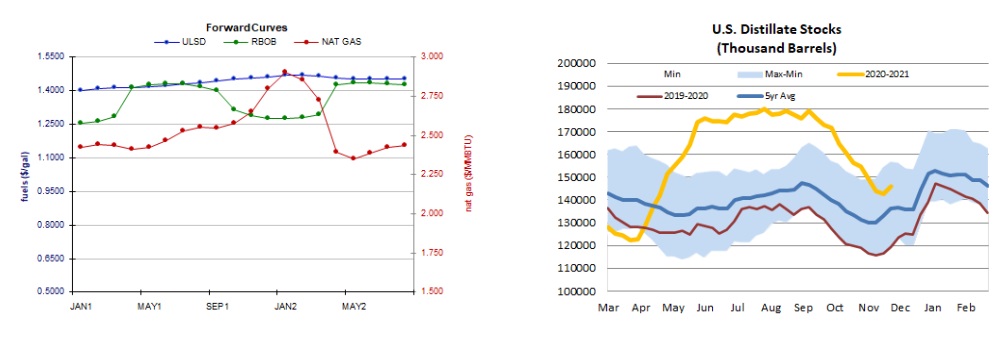

NATURAL GAS | WEATHER | INVENTORIES

Natural gas futures, following a bounce on Friday after a sharp decline on Thursday, continued their plunge today with a weaker heating degree day outlook. Although the 1-5 day outlook (ECMWF) calls for near to below-normal temperatures along the eastern seaboard, above-normal temperatures are expected elsewhere with particularly high deviations above normal seen in the Midwest. Moreover, the 6-10 and 11-15 day forecasts both call for above-normal temperatures across the country. Based on the US Global Forecast System, NOAA's CPC sees 222 oil home heating population-weighted heating degree days in New England in the week through Saturday, with 194 HDDs in the Middle Atlantic. Over the next two weeks, the GFS sees 369 HDDs for the Lower 48, down from 369 previously. Refinitiv analysts expect total US demand of 117.8bcf/d to outpace total US supply of 99.2bcf/d this week, implying 18.6bcf/d withdrawals. The market is seen tightening next week, with demand rising to 118.9bcf/d and supply falling to 98.7bcf/d. In the cash market, Henry Hub prices rose 2 cents to $2.48/mmBtu, Transco Zone 6 prices jumped 63 cents higher to $2.50/mmBtu, and Algonquin citygate prices shot up 73 cents to $2.89/mmBtu, perhaps with a boost from the return of weekday industrial demand.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures edged down 0.3% today in a thinly-traded downside session, doing nothing to push us off of the sidelines. This was not very strong bearish confirmation following Friday's shooting star. We continue to look to the recent $1.4201 high and then to $1.4600 for resistance, with support expected at $1.3500 and then down at $1.3068. RBOB futures fell 1.0% in a downside session after their shooting star, which makes a stronger case for the bears. We'll exercise caution and look to see how we fare tomorrow before siding with them, however, as stochastics still point higher along with the MACD and major averages. Next resistance remains at $1.2960 and then $1.3500, with support seen at $1.2546 and then at the 100-day ma ($1.2016). WTI futures slipped 1.1% lower in a downside session, and we remain neutral. The 9-day ma ($45.44) served as a floor for most of today's session. We still look to $43.79 and then $40.00 support, however, with $50.54 and then $52.17 as our nearby resistance levels. Finally, we noted that the bounced in NG on Friday could be a bounce following the sharp drop on Thursday, and that appears to be the case, as futures dropped another 6.6% lower in a downside session today. The 100-day ma ($2.494) served as a ceiling today, but we're keeping a closer eye on $2.403 (held on a settlement basis) and then 200-day ma ($2.123) support. Nearby resistance expected at the 100-day ma and then up at $2.762 and $2.898.