The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

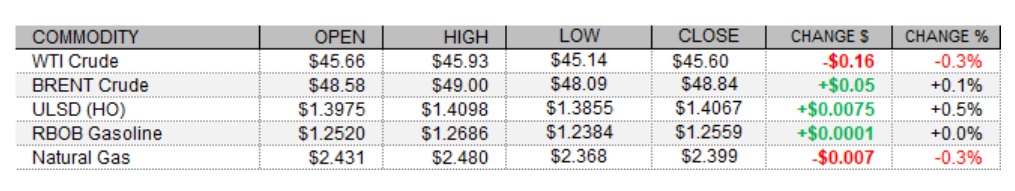

Petroleum futures settled mixed near the unchanged mark today with a bearish revision to the 2020 global oil demand forecast in the EIA's Short-Term Energy Outlook, strength in the US dollar, and mixed trade in European equities likely weighing, while gains in US shares and news that the first fully-tested COVID-19 vaccine shot was administered to a person in the UK were supportive. The EIA released its December STEO today, in which the agency said it expects US crude oil production to fall by 910kb/d in 2020 to 11.34mb/d, a sharper decline than in its previous forecast of 860kb/d. Output is expected to fall by another 240kb/d to 11.10mb/d next year, down from a 290kb/d slide previously forecasted. The EIA estimates that the global consumption of petroleum and liquid fuels will average 92.4mb/d for the entire 2020 year, which is down by 8.8mb/d from 2019, but global demand is expected to increase by 5.8mb/d in 2021. In economic news, the second estimate of third quarter US nonfarm productivity was revised down from 4.9% to 4.6%, while expectations called for no change. On the other hand, unit labor costs were also expected to be unrevised but were revised up from -8.9% to -6.6%. US stock market indexes were seeing gains of between 0.3% (S&P 500) and 0.4% (Dow, Nasdaq) as of this writing. European shares closed mixed today with the FTSE 100 and the DAX both up 0.1%, while the CAC 40 fell 0.2%. The US dollar index was up 0.1%, which is unsupportive for crude prices.

NATURAL GAS | WEATHER | INVENTORIES

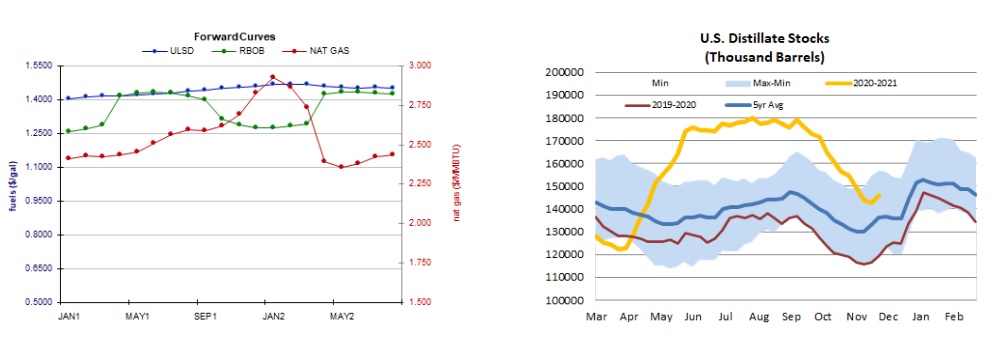

Natural gas futures fell further today amid a weaker two-week heating degree day forecast. The Global Forecast System raised its heating degree day forecast for the next two weeks by 4 to 370, which is closer to, but still well below, the 30-year average of 423 and last year's 402 HDDs over the same period. Refinitiv analysts now see total US demand of 120.2bcf/d outpacing US supply at 99.9bcf/d next week, implying slightly larger withdrawals of 20.3bcf/d (compared to yesterday’s forecast at 20.3bcf/d). The latest 1-5 day forecast (EC) sees well above-normal temperatures in the Midwest but near to above-normal temperatures in the Northeast. The 6-10 and 11-15 day outlooks are also unsupportive with above-normal temperatures expected in both regions. In the cash market today, prices at the Henry Hub benchmark fell from $2.48 at $2.39/mmBtu and Transco Zone 6 prices in New York fell from $2.50 to $2.37/mmBtu, while Algonquin citygate prices rose by one cent to $2.90/mmBtu. According to a Reuters poll of analysts, estimates for the weekly EIA petroleum inventory report for the week ended December 4 call for a 1.4mb draw from US crude stocks amid a 0.6 percentage point predicted increase in the nation’s refinery utilization rate. On the other hand, distillate stocks are expected to rise by 1.4mb and gasoline stockpiles are expected to increase by 2.3mb. API petroleum inventories for the same week are due this afternoon at 4:30.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures edged up 0.5% today but in a downside session (lower high and a lower low). The 9-day ma ($1.3822) once again served as a floor to the price action. Volume was fairly tepid for December. We remain neutral, with slow stochastics looking set to cross for a sell signal right at the overbought line; the RSI remains oversold as well. Nearby resistance at the recent $1.4201 high, followed by $1.4600, whereas $1.3500 and then $1.3068 are our nearby support levels. RBOB futures settled just a tick above the unchanged mark in a downside session today, quite consistent with our neutral stance and suggesting we were prudent in refraining from siding with the bears just yet. We continue to look to $1.2960 and then $1.3500 for nearby resistance, with support at $.2546 and then at the 100-day ma ($1.2020). Major averages are neutral/bullish and the MACD points higher, but slow stochastics and the RSI are neutral and candlesticks are trending south over the past three sessions. WTI edged down 0.3% in a downside session today, settling just north of the 9-day ma ($45.52). With this holding up to four tests in the past five sessions, we'll look to it for further support, followed by $43.79 and $40.00, whereas $50.54 and then $52.17 are expected to offer resistance. We remain neutral, given a mixed technical picture. Natural gas futures continued lower today, consistent with our directional bias - but we settled off of the lows and near the middle of the range for a dip of just 0.3%. It seems bears were unable to take us far away from what was $2.403 support and is now nearby resistance, followed by the 100-day ma ($2.501). Next support at $2.258 and then at the 200-day ma ($2.126).