The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

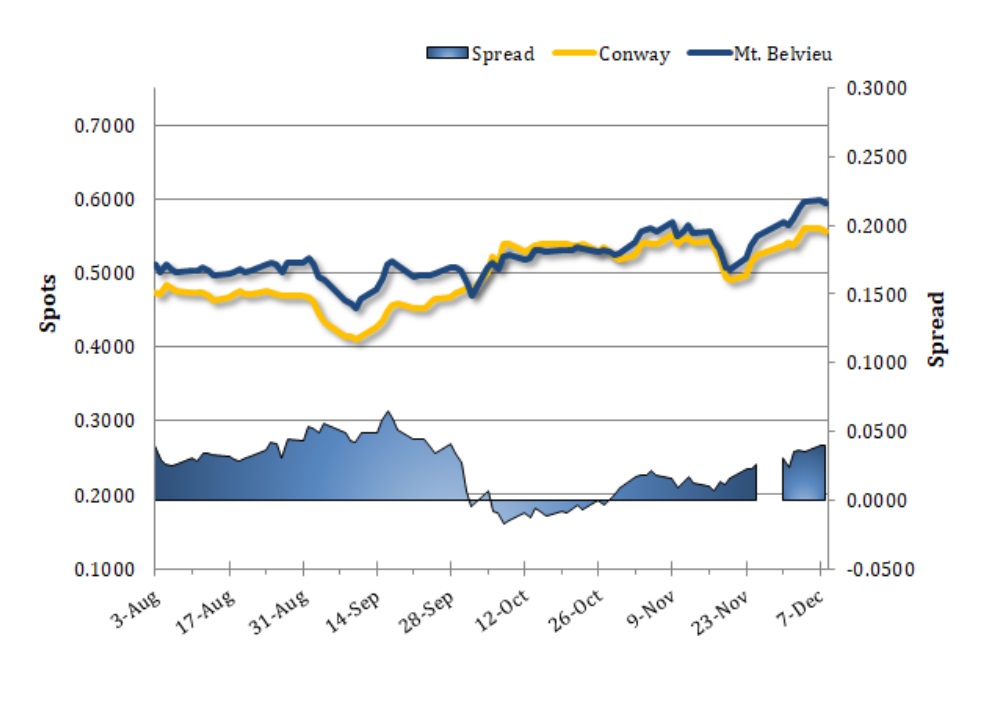

Benchmark propane prices fell back on Tuesday, causing Mt. Belvieu to end a four-session rally. Mt. Belvieu TET prices fell 0.8% (50 points) to 59.44c/g and Conway spot prices lost 0.9% (also 50 points), dropping to 55.50c/g. The losses came despite mixed trade in crude futures. Brent edged up 0.1%, but WTI slipped 0.3% lower. The EIA, in its monthly Short-Term Energy Outlook, revised down its US oil production forecast, which was supportive. The agency left its global oil demand forecast for this year unchanged. Natural gas futures traded on NYMEX edged down 0.3% yesterday.

Crude futures opened higher today but fell back into negative territory following a bearish crude oil inventory report from the EIA. As of this writing, WTI futures were down 0.8% and Brent crude futures were off 0.1% despite news that two small oilfields in northern Iraq had been set on fire by explosives and strength in European shares. US shares were in the red. Ahead of the weekly EIA inventory report, propane prices were falling fairly sharply. Mt. Belvieu TET anys had dropped 2.4% (1.44 cents) lower to 58.00c/g (non-TET at 58.38c/g) and Conway prices had lost 2.5% (1.38 cents) to hit 54.13c/g.

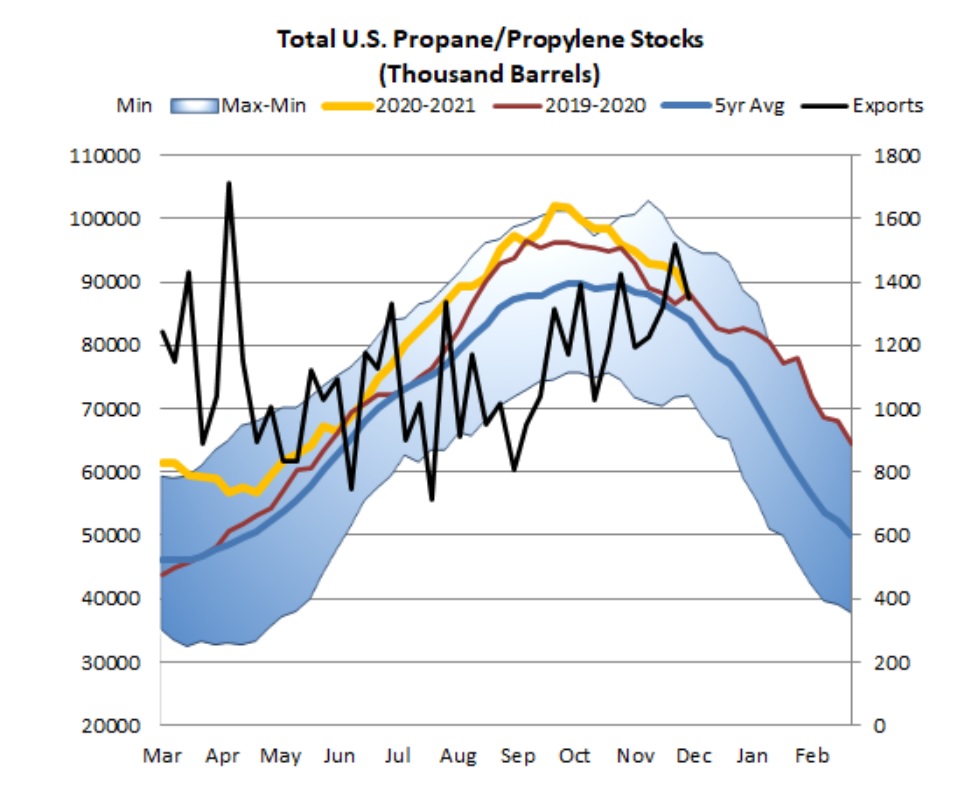

Whereas EIA crude oil, distillate, and gasoline inventory data were bearish, data for combined propane and propylene stock levels were bullish. The agency reported a 4.08mb draw from stockpiles, well in excess of the 1.41mb drop predicted by analysts. The sharp withdrawal came as implied demand recovered, even as exports slowed and both production and imports increased marginally. Implied demand jumped 67% (681kb/d) higher to average 1.69mb/d, which is well above the 1.30mb/d seen during the same week last year. Meanwhile, exports fell by 11% (174kb/d) to average 1.35mb/d, which is lower than last year's 1.54mb/d the same week. Production rose slightly to average 2.31mb/d and imports picked up to an average of 0.15mb/d. Most of the draw was on the Gulf Coast, where stock levels plunged 3.06mb lower to 48.16mb, putting them at a 0.8% deficit to the five-year average, quite the reversal compared to just weeks ago. Midwestern inventories, meanwhile, saw a marginal build to 25.77mb and are now 4.1% higher than their five-year average for the week. This developments supports a wider discount for Conway prices relative to Mt. Belvieu. East Coast inventories fell by 0.7mb to 8.0mb, which is still 15.3% above the five-year average. US stock are still 4.5% above their five-year average as well, but also 0.5% lower than last year.