The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

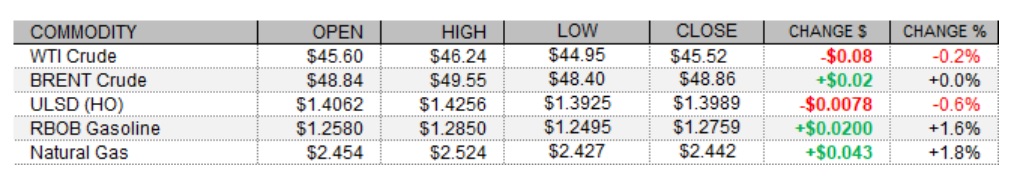

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

The complex see-sawed today, opening higher ahead of the weekly EIA inventory report with likely support from a weaker US dollar and strength in European shares - but prices turned south after EIA release bearish crude oil, gasoline, and distillate stock data (figures were bullish for propane, however). The German merchandise trade surplus hit E18.2bn in October, beating the E18.0bn expectation, and the DAX gained 0.5% today. The FTSE 100 edged up 0.1%, but the CAC 40 in France fell 0.3%. In US news, the Job Openings and Labor Turnover Survey (JOLTS) put openings at 6.652m in October, beating expectations at 6.400m and up from an upwardly-revised 6.494m in September. In supportive supply-side news today, Reuters reports that two small oilfields in northern Iraq were set on fire by explosives. As did crude futures, US equity indexes turned south today and as of this writing we were seeing losses of 0.3% in the Dow, 0.6% in the S&P 500, and 1.1% in the Nasdaq. Also unsupportive for crude oil prices, the US dollar index had recovered and was up 0.19%.

NATURAL GAS | WEATHER | INVENTORIES

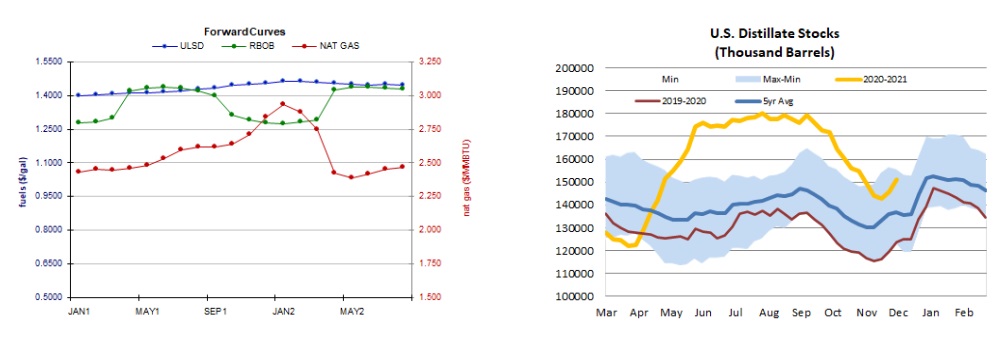

Natural gas futures on NYMEX turned northwards today with a tightening picture of next week's market balance and an improvement in the 6-10 day outlook regarding heating degree days. Refinitiv sees total US demand of 119.9bcf/d next week outpacing total US supply of 98.9bcf/d, implying withdrawals from storage of 21.0bcf/d. While the latest 1-5 day ECMWF outlook sees above-normal temperatures across the country, the 6-10 day forecast calls for below-normal temperatures across much of the country, except for the West, upper Midwest, and with some more mixed temperatures in the Central Atlantic (PADD1B) region. For the next two weeks overall, the Global Forecast System continues to see 370 HDDs, which is well below the 426-HDD 30-year average and also last year's 402 HDDs during the same period. Cash natural gas prices fell today, with Henry Hub prices down 3 cents to $2.36/mmBtu, Transco Zone 6 prices in New York down 11 cents to $2.26/mmBtu, and Algonquin citygate prices dropping 32 cents lower to $2.58/mmBtu. The EIA is due to release its weekly natural gas storage report tomorrow, expected to show an 87bcf withdrawal that would top both the 57bcf drop seen last year and the 61bcf five-year average.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures fell 0.6% but did so in an upside session – consistent with out neutral bias which we maintain. We continue to see nearby support at $1.3500 and then down at $1.3068, while $1.4201 and $1.4600 are expected to offer nearby resistance. Slow stochastics and candlesticks are neutral, while the RSI points lower, and the MACD and moving averages are bullish. RBOB futures settled 1.6% higher in an upside session today. Slow stochastics and the RSI are neutral, along with candlesticks, while the MACD points higher. We are going to remain on the sidelines, still seeing nearby resistance at $1.2960 and then up at $1.3500, with $1.2546 and the 100-day ma ($1.2024) as nearby support. Consistent with our neutral bias, WTI edged down 0.2% in an outside session, taking out the 9-day ma ($45.49), which has served as a floor in the past four out of six sessions. We remain neutral, seeing nearby support at $43.79 and then down at $40.00, whereas the 9-day ma and then $50.54, followed by $52.17, are expected to offer resistance. Natural gas futures gapped higher but fell intraday, still settling 1.8% higher in an upside session – printing an inverted hammer shaped candlestick which is a bullish reversal signal pending confirmation. Slow stochastics are oversold and look set to cross bullishly, while the RSI is neutral, along with candlesticks. We are going to remain bearish for a bit longer, awaiting further developments. Bulls took out our $2.403 resistance level, which now becomes our nearby support level, followed by $2.258, while the 100-day ma ($2.509 – tested today) and $2.762 are seen offering resistance.