The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

The complex strayed relatively little away from the unchanged mark today, spending most of the session below it and settling flat to lower. Likely weighing on trade today were losses in European and US shares, strength in the dollar, and another weekly rise in the US oil rig count. In economic news the German Consumer Price Index (CPI) fell 0.8% last month, as expected and initially estimated. Italian industrial production grew 1.3% in October, beating the 1.1% forecast - and came with an upward revision to September output from a 5.6% drop to a 5.1% drop. Nevertheless, European shares fell today with the FTSE 100 and the CAC 40 both losing 0.8% and the DAX dropping 1.4% lower. In US news, the PPI-Final Demand showed producer price inflation of 0.1% last month, matching expectations. Excluding the volatile components of food, energy, and trade services, prices also rose 0.1% - under the 0.2% expectation. US consumer sentiment firmed unexpectedly this month, according to the University of Michigan survey index, which jumped from 76.9 to 81.4, against expectations for a drop to 76.0. Nevertheless, the major indexes were down as of this writing, with the Dow off 0.2%, the S&P 500 having lost 0.7%, and the Nasdaq down 0.9%. Also unsupportive for crude oil, the US dollar index was up 0.15%. In unsupportive supply-side news, Baker Hughes reported another double-digit rise in the oil rig count, which has been rising with WTI prices now back above $40 and, more recently, $45/bbl. The count rose by 12 to 258 this week, although that's still a year-on-year drop of 409.

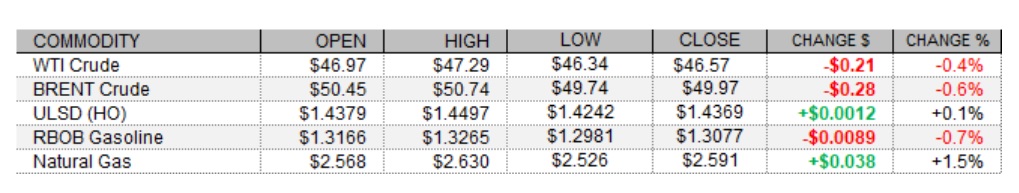

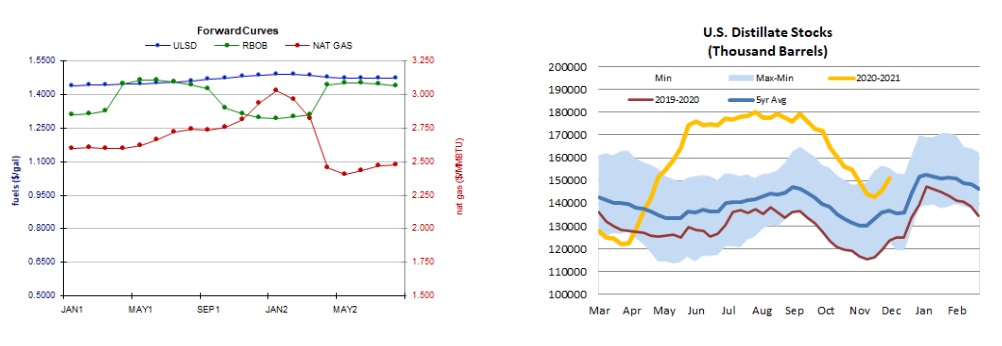

FORWARD CURVES & DISTILLATE STOCKS

NATURAL GAS | WEATHER | INVENTORIES

Natural gas futures on NYMEX strengthened further today with an upward revision to the two-week heating degree day forecast and a tighter market balance expectation for next week. The Global Forecast System sees 394 HDDs over the next two weeks, up from 375 previously and closer to the 30-year average of 432, and also closer to last year's 402 HDDs over the same period. Also supportive, Refinitiv analysts revised up their total US demand forecast for next week by 1.1bcf/d to 121.5bcf/d, while trimming their total supply forecast by 0.1bcf/d to 99.0bcf/d, implying larger withdrawals of 22.5bcf/d. It was not all supportive news today, however, as Baker Hughes reported a relatively large increase in the natural gas rig count this week of 4 to 79. The latest ECMWF 1-5 day outlook calls for above-normal temperatures in both the Northeastern and Midwestern consuming regions. Above-normal temperatures are seen persisting in the 6-10 day forecast in the Midwest, but below-normal temperatures are expected on the East Coast, particularly in New England. The 11-15 day outlook calls for warmer than normal temperatures in both regions. In the cash market, benchmark Henry Hub prices held steady at $2.45/mmBtu, but Transco Zone 6 prices at the New York citygate fell 35 cents to $2.00/mmBtu, and Algonquin citygate prices dropped 48 cents lower to $2.18/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures were little changed today, edging up 0.1% in an average-volume inside session that did nothing to push us off of the sidelines. Slow stochastics remain bearish while the RSI remains overbought, but the MACD, major averages, and ADX point higher. Candlesticks are neutral and we saw a Doji star pattern printed today, indicating ambivalence. Again, we remain neutral, looking to yesterday's $1.4619 and then to $1.5000 for resistance, with 9-day ma ($1.3986) and then $1.3500 support. RBOB futures, where we adopted an upside bias yesterday, instead slipped 0.7% lower in an inside session. Stochastics point higher, but the RSI is losing steam, while the MACD, candlesticks, and major averages still point higher. We'll stick with the bulls for now, seeing next resistance at $1.3500 and then $1.3899, whereas $1.2546 and then the 18-day ma ($1.2409) are nearby support. Similarly, WTI futures edged down 0.4% in an inside session today. Here we were neutral, however, and the price action was consistent with that view. Stochastics and the RSI are neutral, whereas candlesticks, the MACD, and major averages point higher. Next resistance remains at 50.54, followed by $52.17, whereas the 9-day ma ($45.77) and then $43.79 are seen offering support. Finally, NYMEX natural gas futures gapped higher and closed 1.5% stronger in today's upside session, indicating we were right in abandoning the bears yesterday. Slow stochastics are looking bullish, the RSI has plenty of room overhead, major averages remain slightly bullish, and so are candlesticks. The MACD remains bearish, but is narrowing towards a cross. We'll await a stronger showing from the bulls before siding with them, however, looking to $2.762 and then $2.898 for nearby resistance, while the 100-day ma ($2.527) and then $2.403 are expected to offer nearby support.