The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

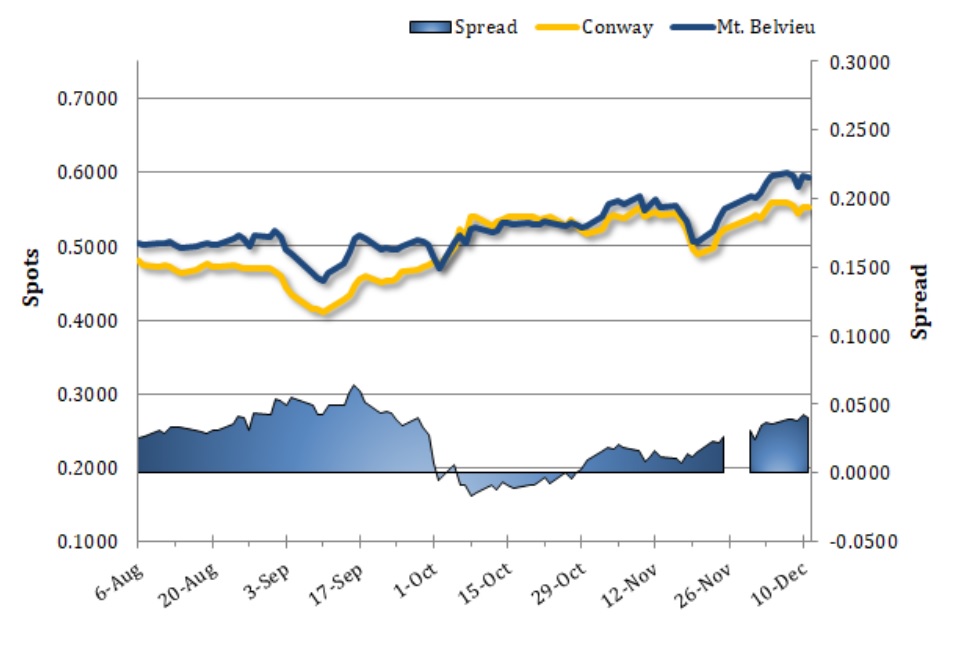

Along with crude futures prices, propane prices slipped lower on Friday. Brent crude shed 0.6% and WTI edged down 0.4% amid weakness in US and European shares, strength in the dollar, and another weekly increase in the US oil rig count. Mt. Belvieu TET propane prices shed 0.5% (31 points), hitting 59.31c/g, and Conway spot prices edged down 0.2% (12 points) to 55.25c/g, putting the north-south spread just above four cents. Meanwhile, NYMEX natural gas futures added 1.5% with a stronger two-week heating degree day forecast from the GFS.

PROPANE SPOT PRICES

Crude futures prices were seeing see-saw trade today, opening higher along with equities as distribution of the Pfizer/BioNTech COVID-19 vaccine got underway in the US, and with additional support from crude likely stemming from news of another tanker attack in Jeddah. Prices came off their earlier highs, however, after OPEC released its Monthly Oil Market Report, which showed the organization made bearish global oil demand forecast revisions for both this year and next year, and that OPEC output rose significantly last month, led by Libya. As of this writing, WTI futures were up 0.2% and so were Brent crude futures. Propane prices were strengthening earlier along with crude. Mt. Belvieu TET prices were up 1.0% or 56 points at 59.88c/g (non-TET at parity) and Conway spots had gained 1.6% (88 points) to trade at 56.13c/g, implying a narrowing of the north-south spread.

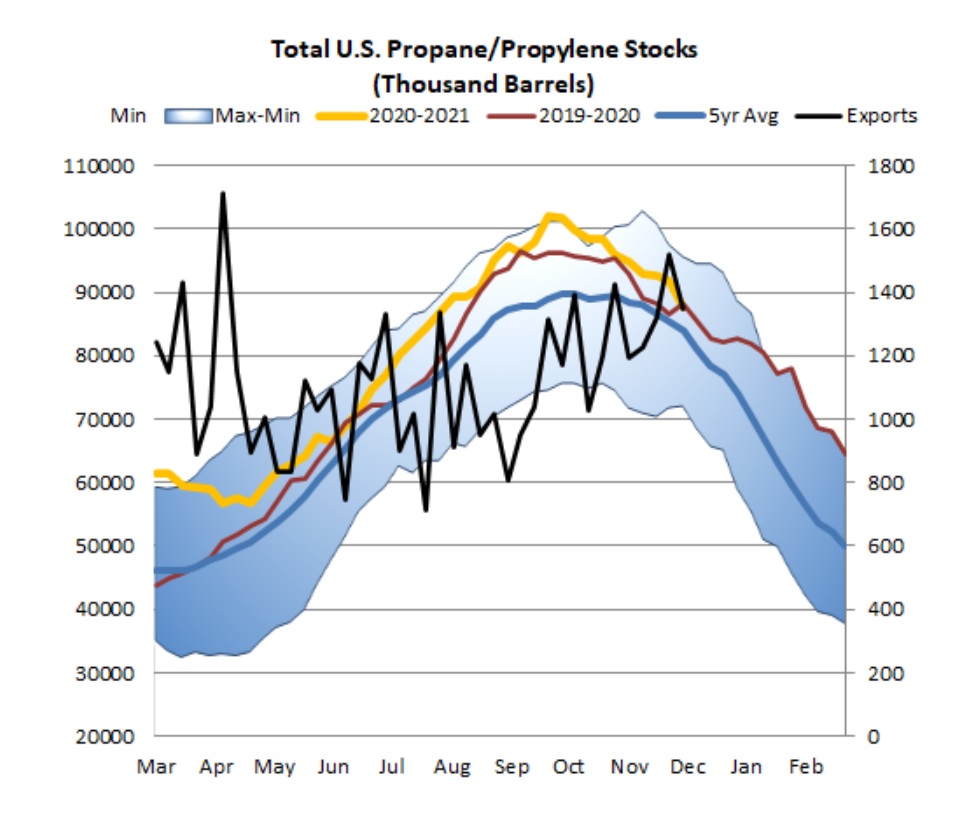

US PROPANE / PROPYLENE STOCKS