The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

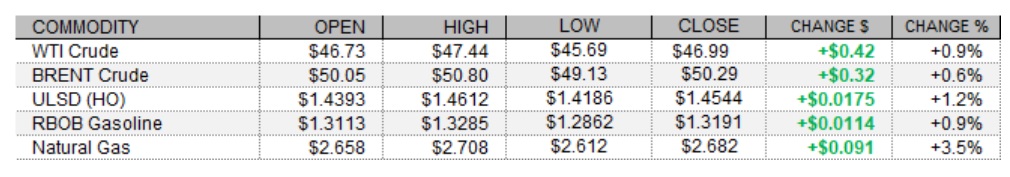

PETROLEUM COMPLEX (WTI | BRENT | ULSD | RBOB)

The complex saw see-saw trade today, opening higher amid geopolitical tensions, strength in equities, weakness in the US dollar, and optimism with coronavirus vaccine distribution starting in the US, but turning lower following release of a bearish monthly oil market report from OPEC. Futures recovered to settle higher. In supportive news today, a tanker was the target of an attack in Jeddah, Saudi Arabia. Also supportive, distribution of the Pfizer/BioNTech vaccine in the US looked set to begin today. European shares mostly closed higher today, as while the FTSE 100 fell back 0.2%, the CAC 40 climbed 0.4% high and the DAX gained 0.8%. The Stoxx 600 rose 0.4%. US stock market indexes were rising as of this writing, with the Dow up 0.2%, the S&P 500 also up 0.2%, and the Nasdaq trading 0.9% stronger. The US dollar index was down 0.3%, off of earlier lows, but still supportive for dollar-denominated assets such as oil. In unsupportive news, OPEC released its monthly report on the oil market, in which it showed it had cut its global oil demand growth forecasts for both this year (-9.77mb/d) and next (+5.9mb/d), while also showing OPEC output increased by 0.71mb/d last month, driven by gains in Libyan production.

NATURAL GAS | WEATHER | INVENTORIES

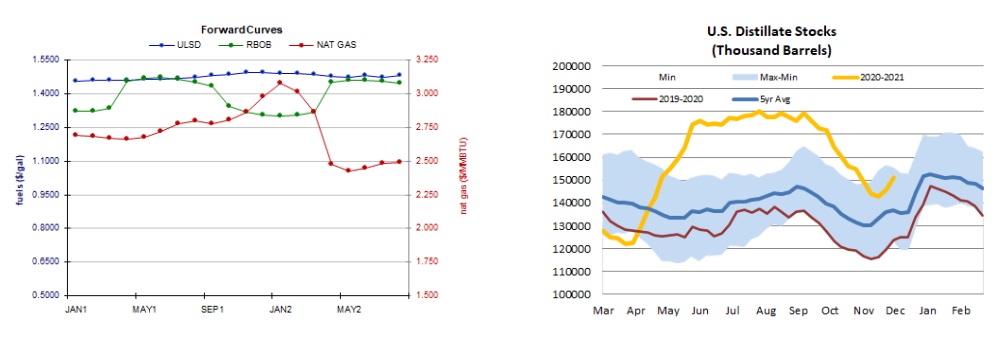

Natural gas futures prices rose today with a stronger degree-day outlook and a tight market balance forecast for the week. Refinitiv analysts see total US demand of 125.0bcf/d, including strong 11.1bcf/d LNG exports, outpacing total US supply of 99.1bcf/d by 25.9bcf/d this week. Next week, the market is seen loosening slightly, with demand at 123.2bcf/d and supply at 99.4bcf/d, implying 23.8bcf/d withdrawals. For the next two weeks, the Global Forecast System sees 424 HDDs, up from 396 previously and closer to the 30-year average of 443. This is also well above last year's 375 HDDs during the same period. The latest 6-10 day outlook (ECMWF) calls for below-normal temperatures across most of the country, except for near the western Great Lakes and in the Pacific Northwest. The 6-10 day and 11-15 day forecasts, however, call for mixed and mostly above-normal temperatures across the country, with relatively large deviations above normal in the Midwest during the 6-10 day period. Cash natural gas prices strengthened, perhaps with the return of weekday industrial demand. Benchmark Henry Hub prices rose by 9 cents to $2.54/mmBtu, Transco Zone 6 prices at the New York citygate added 5 cents to reach $2.05/mmBtu, and Algonquin citygate prices jumped 51 cents higher to $2.69/mmBtu.

ENERGY TECHNICALS (WTI | ULSD | RBOB | NG)

ULSD futures, where we are neutral, added 1.2% today but in an outside session (higher high, but also a lower low). We recovered from the lows to settle in the upper half of the daily range. Bulls were not able to match the $1.4619 highs from two sessions ago, which were nearby resistance (followed by $1.5000), and we remain neutral, seeing 9-day ma ($1.4104, threatened but not hit today) and then $1.3500 support. The MACD, major averages, and ADX point higher, while candlesticks and slow stochastics are neutral, but the RSI is overbought (75.1). RBOB futures, where we favored upside chances, added 0.9%, also in an outside session and settling well off of the lows. Stochastics point higher, as do the RSI, major averages, and the MACD. We continue to favor the upside, seeing $1.3500 and then $1.3899 resistance, with $1.2546 and then 18-day ma ($1.2502) support. WTI futures also closed 0.9% in an outside session, testing 9-day ma support ($46.04) near the lows but settling above it. We continue to look there, followed by $43.79, whereas $50.54 and then $52.17 are our nearby resistance levels. We remain neutral for now. Natural gas futures gapped much higher over the weekend, opening near the 18-day ma ($2.660) and settling still higher for a 3.5% gain in an upside session. We were awaiting a stronger showing from the bulls and received it, and so side with them. Slow stochastics, the RSI, and candlesticks are bullish, and while the MACD is bearish, it is narrowing for a cross. Major averages are neutral. We continue to expect resistance at the $2.762 and then $2.898 levels, whereas the 100-day ma ($2.536) and then $2.403 are seen offering nearby support.